Get Free Demo to our Portal to Manage your Entity

or Start a Local Business.

Starting a business in Portugal opens the door to exciting opportunities in one of Europe’s most attractive markets. Whether you're an international entrepreneur or a local business owner, registering a business here can be both rewarding and straightforward with the right guidance.

We understand that navigating the legal requirements and paperwork can feel overwhelming. That's where we come in. Our dedicated team of experts makes the process easy, guiding you through every step—from selecting the right business structure to fulfilling regulatory obligations. We handle all the complexities, so you can focus on what really matters: growing your business.

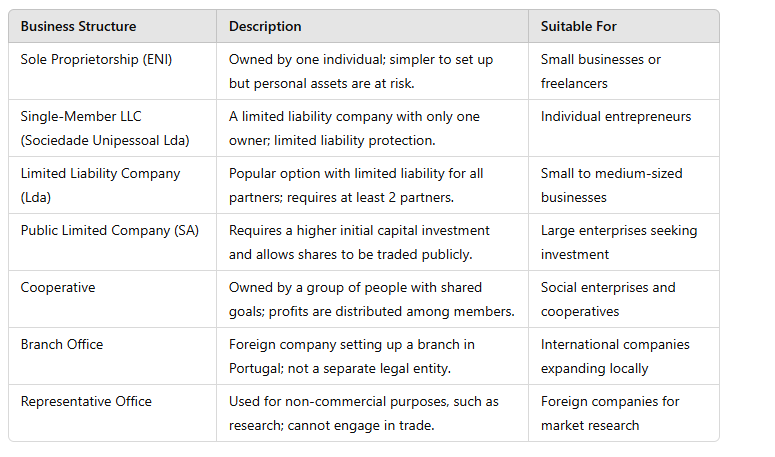

With Portugal's favorable tax environment, skilled workforce, and access to the European market, now is the perfect time to establish your presence. Below is a helpful table outlining the main types of business structures in Portugal:

Are you considering starting a company in Portugal? It's important to know the essential requirements for company formation in the country. From choosing the right legal structure to meeting tax obligations, there are several steps to consider. One option for foreign companies is to set up a branch office, which can be established as a Portuguese Sociedade por Quotas (Lda) with the parent company as the sole shareholder.

In this guide, we'll explore the important elements you need to understand before starting a business in Portugal. This will provide you with the information needed to navigate the process with confidence. Whether you're a local entrepreneur or a foreign investor, understanding these requirements will set you on the right path for success.

There are two popular company structures in Portugal: the private limited company (Sociedade por Quotas - Lda) and the public limited company (Sociedade Anónima - SA). Both offer limited liability, but Lda is more flexible and requires less share capital than SA. A Portuguese Lda is a popular choice for both domestic and foreign entrepreneurs due to its limited liability and lower capital requirements.

To establish a company in Portugal, obtaining a Portuguese Tax Identification Number (NIF) and registering with the Portuguese Commercial Register are necessary. Companies operating in Portugal also need to consider tax and financial implications, such as Portuguese taxation, financial reporting requirements, and tax treaties with other nations.

Portugal offers an attractive tax climate for foreign investors, with various tax incentives and treaties aimed at preventing double taxation. Understanding these considerations is crucial for successfully forming and operating businesses in Portugal.

Understanding Legal Structures in Portugal

The most popular legal structures for company formation in Portugal are:

A Portuguese Lda is particularly attractive for foreign entrepreneurs due to its limited liability and the ability to register online, even from abroad.

The business registration process in Portugal is streamlined but requires careful attention to detail. To start a business, you need to register your business with the Portuguese Commercial Register (Registo Comercial).

Key Steps in Business Registration

When selecting the appropriate business structure in Portugal, it’s crucial to weigh the legal and operational implications of each option available.

For instance, a private limited liability company (Sociedade por Quotas, Lda) offers limited liability protection to its shareholders, meaning personal assets are safeguarded from business debts. In contrast, a sole proprietorship (Empresário em Nome Individual) exposes the owner to unlimited personal liability, putting their personal assets at risk if the business encounters financial difficulties.

Taxation is another critical aspect that varies between structures. An Lda may offer more favorable tax treatment compared to a partnership, allowing for potential tax benefits that can enhance overall profitability. Furthermore, the complexity of employment regulations also differs; for example, a corporation faces more stringent regulatory and reporting requirements compared to a sole proprietorship, which generally has simpler compliance obligations.

Additionally, intellectual property protection is an essential consideration. The chosen structure can influence a company's ability to protect its innovations and brand assets effectively. Corporations often have more robust frameworks for safeguarding intellectual property compared to simpler structures like sole proprietorships, making this a vital factor in your decision-making process.

Legal Requirements

Legal Representative: Non-residents must appoint a legal representative in Portugal.

Company Types: Common types include Sociedade por Quotas (Lda) and Sociedade Anónima (SA).

Minimum Share Capital: Lda requires a minimum share capital of €1 per shareholder, while SA requires €50,000.

Registration Process

Company Name: Ensure the company name is unique and register it with the National Registry of Collective Entities (RNPC).

Commercial Registry: Register the company at the Commercial Registry Office.

Tax Identification Number (NIF): Obtain a NIF for all shareholders and directors.

Social Security: Register the company and employees with the Social Security system.

Financial Considerations

Bank Account: Open a corporate bank account in Portugal.

Accounting: Maintain proper accounting records and appoint a certified accountant.

Taxes: Understand corporate tax obligations, including VAT, corporate income tax, and social security contributions.

Operational Considerations

Office Space: Secure a physical address for the company, which can be a rented office or a virtual office.

Employment: Familiarize yourself with local labor laws and employment contracts.

Permits and Licenses: Obtain any necessary permits and licenses specific to your business activity.

Support and Resources

Business Support Services: Utilize services from local business support organizations and chambers of commerce.

Legal and Financial Advisors: Engage with local legal and financial advisors to navigate the regulatory environment.

Government Incentives: Explore government incentives and grants available for foreign investors.

Cultural and Language Considerations

Language: Portuguese is the official language; consider hiring bilingual staff or translators.

Business Culture: Understand the local business culture and practices to facilitate smoother operations and negotiations.

Establishing a company in Portugal as a non-resident involves navigating various legal, financial, and operational requirements. Engaging with local experts and utilizing available resources can significantly ease the process.

Opening a business in Portugal through branch registration requires a clear understanding of the distinction between a branch and a subsidiary. A branch registration allows a foreign company to establish a physical presence in Portugal without forming a separate legal entity. This means that the foreign company retains full responsibility for the activities conducted by the branch, including any legal and financial obligations that may arise.

In contrast, establishing a subsidiary involves creating a new legal entity in Portugal that operates independently from the foreign parent company, with its own legal and financial responsibilities. When considering branch registration, it's essential to carefully assess how this decision impacts the foreign company's operations, liabilities, and overall strategy. A branch may be more suitable for companies seeking to maintain direct control over their Portuguese operations, as it reflects the parent company's objectives, policies, and strategies more closely.

Before proceeding with branch registration, it's wise to consult with experts who can help navigate the legal and administrative requirements, ensuring a smooth setup process for your business in Portugal.

When considering company formation in Portugal, entrepreneurs have several types of legal entities to choose from, each tailored to different business needs and goals.

One of the most common options is the Private Limited Company (Sociedade por Quotas, Lda). This structure provides limited liability to its owners, meaning they are not personally responsible for the company’s debts. The Lda is particularly appealing for small to medium-sized enterprises, as it allows for flexible management and fewer statutory obligations.

Another option is the Public Limited Company (Sociedade Anónima, SA), typically suited for larger businesses. The SA can issue publicly traded shares, making it an ideal choice for companies seeking to raise capital through public offerings. This structure also provides limited liability, protecting shareholders from personal liability for the company's debts.

For those interested in a more collaborative approach, the Cooperative (Cooperativa) may be the right fit. This entity allows a group of individuals to come together for a common economic purpose, with members sharing both profits and responsibilities.

If you prefer a simpler structure, a Sole Proprietorship (Empresário em Nome Individual) is the easiest form to establish. While it allows full control over the business, it does not provide limited liability protection, meaning the owner is personally liable for any debts incurred.

Additionally, Portugal offers Partnerships (Sociedade em Nome Coletivo), where two or more individuals share the responsibilities and profits of the business. While this structure allows for flexibility, partners can be personally liable for the partnership's debts.

Each type of legal entity comes with its own set of advantages and drawbacks, making it crucial for entrepreneurs to evaluate their specific needs and long-term goals before deciding on the best structure. Consulting with legal and financial professionals can provide invaluable guidance in navigating Portugal's regulatory landscape and ensuring compliance with tax laws. The Corporate Plan offered by Entity Management Services in Portugal is an excellent resource for obtaining tailored advice. For a fixed fee, you can receive a customized and interactive report that covers all your business requirements, including updates and a compliance calendar for the year.

Regardless of the legal entity chosen, all businesses must register with the Portuguese Commercial Registry (Registo Comercial) to ensure compliance with Portuguese regulations and to operate legally within the country.

Sign up by completing the form below.

When considering expansion into Portugal, selecting the right legal business structure is a pivotal step for global entrepreneurs. The Portuguese market, with its strategic location and favorable business environment, offers various avenues for foreign companies to establish their presence. Among these options, registering a branch can be particularly appealing for international firms looking to tap into Portugal's dynamic economy.

A branch registration in Portugal allows foreign companies to engage in local business activities while maintaining the parent company’s identity and control. This option provides a streamlined way to explore the Portuguese market without the complexities associated with creating a separate legal entity. For many entrepreneurs, this flexibility is invaluable, as it enables them to assess market conditions and test their offerings without committing to a full-scale investment.

Moreover, in some instances, foreign companies can operate without the necessity of forming a local entity. Activities such as obtaining a VAT number or hiring employees can often be managed without registering a branch, adding another layer of convenience for businesses looking to enter the Portuguese market. This flexibility makes Portugal an attractive destination for global entrepreneurs eager to expand their operations and reach new customers.

Registering your company with the Portuguese Commercial Register involves several key steps. First, you need to ensure that your company name is unique and register it with the National Registry of Collective Entities (RNPC). This step is crucial to avoid any conflicts with existing businesses. Once the name is approved, you must prepare and submit the necessary documentation, including the company's articles of association, identification documents of the shareholders and directors, and proof of the initial share capital deposit.

Next, you need to register the company at the Commercial Registry Office (Conservatória do Registo Comercial). This process involves filling out the appropriate forms and paying the required fees. The registration will officially recognize your company as a legal entity in Portugal, allowing it to operate within the country. Additionally, you will need to obtain a Tax Identification Number (NIF) for the company and register it with the Portuguese Tax Authority (Autoridade Tributária e Aduaneira).

Finally, ensure compliance with social security obligations by registering the company and its employees with the Social Security system. This step is essential for legal employment and to provide social benefits to your employees. It's also advisable to open a corporate bank account in Portugal to manage the company's finances and facilitate transactions. By following these steps, you can successfully register your company with the Portuguese Commercial Register and start your business operations in Portugal.

To register a company in Portugal, you need to prepare the following essential documents:

Notarized Articles of Association: This document outlines your company's structure and operational rules.

Proof of Identity: A valid identification document for each director and shareholder is required.

Deed of Incorporation: This must be notarized and is essential for the registration process.

Once these documents are ready, the registration process involves submitting them to the Portuguese Commercial Registry (Registo Comercial) and paying the necessary registration fee. Upon successful registration, you will receive a unique company number, which is essential for conducting business in Portugal.

If you're a non-resident, you may need to appoint a local representative or use a registered agent to facilitate the registration process. Additionally, depending on your business type, you may be required to obtain specific licenses or permits.

Understanding these requirements is vital to ensuring a smooth and efficient registration process in Portugal.

When preparing the Articles of Association for a company in Portugal, it’s crucial to include essential elements that define the company's framework. These elements typically consist of the company name, registered office address, business purpose, and the rights and obligations of the shareholders. Additionally, it’s important to specify the distribution of shares, governance structures, and the company’s decision-making processes.

Having these components clearly outlined promotes transparency and helps ensure smooth internal operations. It also ensures compliance with Portuguese legal requirements for company formation. This legal document is foundational, outlining how the company will operate within Portugal’s regulatory framework.

To ensure accuracy and legal compliance, consulting with legal advisors is highly recommended. They can help tailor the Articles of Association to reflect the company’s specific structure and goals, ensuring that all necessary details are included, such as the rights of shareholders and the decision-making hierarchy.

Appointing directors and shareholders in Portugal is a straightforward process, but it’s essential to understand its implications on the company’s governance. A Portuguese company requires at least one director, who may also be a shareholder, to manage the business. This flexibility allows a single individual to hold both roles, which can simplify management, especially for smaller companies.

The selection of directors and shareholders plays a significant role in shaping the company’s operations and strategic direction. It’s important to appoint individuals with the right qualifications and experience, as directors are responsible for making key decisions and representing the company in official matters. Shareholders, on the other hand, provide capital and play a critical role in governance, including voting on significant business issues and receiving dividends.

When appointing directors and shareholders in Portugal, consider their expertise, reputation, and alignment with the company’s vision. A solid understanding of Portuguese corporate laws and regulations is also crucial to ensure compliance and reduce legal risks.

Opening a business bank account in Portugal requires meeting specific legal and documentation requirements. First, your company must be registered with the Portuguese Commercial Registry (Registo Comercial), and you must have a valid business address in Portugal. Essential documents for the bank account application typically include the Articles of Association, proof of registration with the Portuguese tax authorities (NIF - Número de Identificação Fiscal), and identification documents for the directors.

For non-residents looking to open a business bank account in Portugal, there are additional regulations to be aware of. These may include providing proof of residency in Portugal or the EU, as well as documentation to demonstrate legal representation, such as a local agent or representative. These requirements are in place to ensure compliance with Portuguese banking regulations and anti-money laundering laws, safeguarding the integrity of the financial system.

Steps to Open a Business Bank Account

Choose a Bank: Research and select a bank that offers services tailored to your business needs. Popular banks in Portugal include Caixa Geral de Depósitos, Banco Santander Totta, and Millennium BCP.

Prepare Documentation: Gather the necessary documents, which typically include:

Visit the Bank: Schedule an appointment with the chosen bank. It is advisable to have a legal representative or a translator if you are not fluent in Portuguese.

Submit Documentation: Provide the required documents to the bank. The bank may also require additional information about the nature of your business and its expected financial activities.

Account Approval: The bank will review your application and documents. Once approved, you will receive the account details and can start using the account for your business transactions.

Considerations

Bank Fees: Be aware of the various fees associated with the account, such as maintenance fees, transaction fees, and foreign exchange fees.

Online Banking: Ensure the bank offers robust online banking services for easy management of your account.

Customer Support: Choose a bank with good customer support, preferably with services available in English if you are not fluent in Portuguese.

Tips

Local Assistance: Consider hiring a local accountant or legal advisor to assist with the process and ensure compliance with all local regulations.

Multiple Accounts: Depending on your business needs, you might want to open multiple accounts for different purposes, such as operational expenses, payroll, and savings.

Opening a business bank account in Portugal involves selecting a suitable bank, preparing the necessary documentation, and following the bank's application process. With proper preparation and local assistance, you can efficiently set up your business banking operations in Portugal.

Name Registration: Registering the company name with the National Registry of Collective Entities (RNPC) typically costs around €75.

Commercial Registry Fees: The cost to register the company at the Commercial Registry Office (Conservatória do Registo Comercial) is approximately €360.

Notary Fees: If you require notary services for document certification, the fees can range from €100 to €200.

Legal Representation: Appointing a legal representative may incur additional costs, which can vary depending on the service provider.

Initial Share Capital: For a Sociedade por Quotas (Lda), the minimum share capital is €1 per shareholder. For a Sociedade Anónima (SA), the minimum share capital is €50,000.

Other Costs: Additional costs may include obtaining a Tax Identification Number (NIF), social security registration, and opening a corporate bank account.

To legally operate in Portugal, businesses must register with the Portuguese Commercial Registry (Registo Comercial) and the local tax authorities (Autoridade Tributária e Aduaneira). The process involves completing the necessary forms, submitting identification documents, and providing proof of a valid business address in Portugal. Additionally, businesses will need to obtain a Portuguese Tax Identification Number (NIF) for both the company and its directors.

The Registo Comercial serves as the central database for all businesses in Portugal. To register, you’ll need to complete an application form and provide your business plan, identification documents, and proof of address. Upon successful registration, you’ll receive a unique company identification number (NIPC), which is essential for legal recognition and conducting business transactions in Portugal.

Once registered with the Registo Comercial, businesses must also register with the Portuguese Tax Authorities (Autoridade Tributária e Aduaneira) to obtain a VAT number and fulfill tax obligations. This registration allows for VAT collection and ensures compliance with corporate tax requirements in Portugal.

As a registered business in Portugal, it is essential to keep your information updated with the Portuguese Commercial Registry (Registo Comercial). You must report any changes in your business activities, management, address, or legal structure to ensure compliance with Portuguese regulations. Here’s how to navigate these responsibilities effectively:

Business Activities: If your company expands or alters its operations, promptly update the Commercial Registry to reflect the new business activities. This ensures accurate classification and compliance with relevant regulations.

Management Changes: Notify the Commercial Registry of any changes in the management team or ownership structure. This includes appointing new directors or altering shareholding arrangements.

Address Changes: If your business relocates to a new address, you must inform the Commercial Registry to maintain accurate records. This is crucial for official correspondence and legal compliance.

Legal Structure Adjustments: Should you decide to change your business's legal structure—such as converting from a sole proprietorship to a limited liability company (Lda)—it is vital to report this to the Commercial Registry. This helps in updating your company details and ensures your legal obligations are met.

Updating Documents: Along with notifying the Commercial Registry, ensure that all relevant documents, such as the Articles of Association and shareholder agreements, reflect the changes made. This maintains transparency and legal integrity.

Remember, while keeping your company information current might seem like housekeeping, it's a crucial step in maintaining your business's legal and financial health in Portugal.

Understanding the taxation landscape in Portugal is crucial for both individuals and businesses. The Portuguese tax system includes various taxes, such as corporate tax, value-added tax (VAT), personal income tax, and municipal taxes.

Portugal provides an attractive environment for businesses, particularly with its competitive corporate tax rates and incentives for specific sectors. The corporate tax rate is relatively favorable, especially for small and medium-sized enterprises (SMEs). Additionally, there are various tax benefits available to businesses engaged in research and development (R&D) or other qualifying activities. The "Patent Box" regime and tax deductions for innovation and investment are examples of incentives that can reduce the tax burden.

For businesses operating in Portugal, compliance with tax regulations is vital. Companies are required to prepare annual financial statements in accordance with Portuguese Generally Accepted Accounting Principles (GAAP), ensuring transparency and accuracy. Depending on the size of the business, financial statements may need to be audited by an external firm, reinforcing the importance of robust financial management.

Maintaining proper tax compliance not only ensures a smooth operation but also positions your business for long-term success in the Portuguese market. Leverage the opportunities that Portugal's tax system offers, and ensure your company is well-prepared to thrive in this dynamic and competitive environment.

The Portuguese tax system offers several benefits for both businesses and individuals, making it an attractive destination for investment and entrepreneurship. Key benefits of the Portuguese tax system include:

1. Competitive Corporate Tax Rates

Portugal's corporate tax rate is relatively competitive compared to other EU countries, particularly for small and medium-sized enterprises (SMEs). The standard corporate tax rate is 21%, with additional regional tax benefits available in certain areas.

2. Incentives for Research and Development (R&D)

Portugal offers generous tax incentives for businesses involved in research and development activities. The R&D tax credit allows companies to offset a portion of their R&D expenses, encouraging innovation and investment in new technologies.

3. Patent Box Regime

The Patent Box regime provides tax incentives for businesses that generate income from the use of intellectual property (IP), such as patents, trademarks, and industrial designs. Companies can benefit from reduced taxation on income derived from qualifying IP assets.

4. Attractive Tax Treaties

Portugal has signed numerous double taxation treaties with countries worldwide, making it easier for international businesses to avoid double taxation on cross-border income. This ensures that foreign companies can operate efficiently in Portugal without facing significant tax hurdles.

5. Special Tax Regimes for Foreign Investors

Portugal has a special tax regime for foreign investors, including the Non-Habitual Resident (NHR) regime, which offers attractive tax exemptions and reduced tax rates for new residents in Portugal. Under this regime, qualifying individuals may benefit from a flat tax rate of 20% on certain income types for up to 10 years.

6. Favorable VAT Regime

The value-added tax (VAT) system in Portugal is in line with the EU framework, and businesses can benefit from various VAT exemptions or reduced rates on certain goods and services. Companies can also reclaim VAT on eligible business expenses, improving cash flow.

7. Tax Deductions for Investment and Innovation

Portugal offers tax deductions for businesses that invest in innovation, such as in machinery, renewable energy, or employee training programs. This incentivizes businesses to grow and modernize, improving their long-term sustainability.

8. Tax Advantages for SMEs and Startups

Portugal has designed tax policies that specifically benefit startups and SMEs, including reduced rates for companies in their early years of operation. These measures help to ease the financial burden on new businesses, allowing them to focus on growth.

9. Simplified Tax Reporting for Small Businesses

For small businesses, Portugal offers a simplified tax reporting system known as the Simplified Regime. This system reduces administrative costs and paperwork, making it easier for entrepreneurs to manage their business finances.

10. Regional Tax Benefits

Certain regions of Portugal offer tax incentives and exemptions to attract investment and promote economic development. For example, areas with lower economic activity may offer reduced corporate tax rates or incentives for companies that set up operations in these regions.

11. Social Security and Employee Benefits

Portugal provides a well-established social security system for employees, including healthcare, pensions, and other welfare benefits. Businesses benefit from a highly educated workforce and a competitive labor cost compared to many other European countries.

By taking advantage of these benefits, businesses can thrive in Portugal's dynamic and supportive tax environment, making it an appealing destination for both local and international entrepreneurs.

Portugal offers several tax incentives aimed at supporting entrepreneurs and businesses, particularly those starting new ventures. These incentives are designed to encourage investment, innovation, and job creation, making Portugal an attractive destination for entrepreneurs. Here are some key tax incentives for entrepreneurs starting a business in Portugal:

1. Non-Habitual Resident (NHR) Regime

The Non-Habitual Resident (NHR) regime is one of Portugal’s most attractive tax incentives for entrepreneurs and investors who relocate to Portugal. Under the NHR regime, individuals who qualify as new residents in Portugal can benefit from:

2. Reduced Corporate Tax Rate for Small Businesses

Portugal offers a reduced corporate tax rate for small businesses, especially those that are starting up. The standard corporate tax rate is 21%, but for companies with annual revenue below €50,000, the rate may be reduced. The tax brackets are structured to benefit SMEs:

3. Tax Incentives for Research and Development (R&D)

For startups focused on innovation, R&D tax credits provide a significant incentive. Companies involved in research and development can benefit from:

4. Patent Box Regime

Portugal's Patent Box Regime allows companies to benefit from a tax reduction on profits derived from qualifying intellectual property (IP). This includes patents, trademarks, and other forms of IP. Under the Patent Box, businesses can:

5. Start-up Tax Exemptions

New businesses in Portugal may qualify for tax exemptions in certain circumstances, such as for businesses in their first three years of operation. These exemptions can apply to:

6. Investment in Innovation Tax Deductions

Entrepreneurs who invest in innovation and environmental sustainability can benefit from additional tax deductions. These incentives may apply to:

7. Simplified Tax Regime for Micro-Enterprises

For micro-enterprises, there is a Simplified Regime available that reduces administrative costs and paperwork. This system is designed for small businesses with lower revenue and simplifies tax reporting, allowing for:

8. Municipal Tax Benefits

Certain regions in Portugal offer local tax benefits to attract investment and promote regional economic development. These benefits can include:

9. Special Tax Regime for Entrepreneurs in the Digital Economy

For digital entrepreneurs, Portugal offers incentives designed to promote the digital economy. These can include:

10. Support for Job Creation

Portugal offers social security incentives to businesses that hire new employees, particularly in the form of exemptions or reductions on social security contributions for hiring young workers or long-term unemployed individuals. This encourages entrepreneurs to expand their teams as their businesses grow.

By leveraging these incentives, entrepreneurs can significantly reduce their tax liabilities, reduce initial operating costs, and access a supportive environment for innovation and business growth. The Portuguese tax system is designed to support startups and entrepreneurs, making it an appealing destination for those looking to launch their business.

In Portugal, all established companies must adhere to specific financial reporting and auditing requirements to ensure transparency and compliance with tax laws. Here’s an overview of these obligations:

1. Maintain Accurate Financial Records

Financial records: Companies are required to keep accurate and detailed financial records, documenting all business transactions and financial activities. This is essential for tax compliance and to ensure that the company operates transparently.

2. Prepare Annual Financial Statements

Every company must prepare and submit annual financial statements, which must include:

1. Balance sheet

2. Income statement (Profit and Loss Account)

Cash flow statement These statements must provide a true and fair representation of the company's financial health, in accordance with

3. Portuguese Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the company’s size and scope.

3. File with the Portuguese Tax Authorities

Financial statements must be filed with the Portuguese Tax Authority (Autoridade Tributária) by a specific deadline. This is crucial for tax reporting and compliance purposes. Failure to submit the required documents on time may lead to fines or other legal consequences.

4. Audit Requirements

The audit requirements depend on the size of the company and other factors:

Small Companies: Generally, small companies are exempt from mandatory audits. Small companies are defined based on their turnover, assets, and number of employees. These companies benefit from reduced administrative costs and reporting obligations.

Medium and Large Companies:

Medium and large companies are required to undergo mandatory annual audits. These audits must be performed by a registered statutory auditor (Revisor Oficial de Contas), who will verify the company's financial statements for accuracy and reliability.

Companies that exceed certain thresholds in terms of turnover, assets, or employees must undergo an audit, regardless of their status as public or private entities.

Listed Companies: Companies listed on the stock exchange or with large public interest are required to comply with International Financial Reporting Standards (IFRS) and undergo an audit.

5. Foreign Companies in Portugal

Foreign companies operating in Portugal must comply with the same financial reporting and audit requirements as local companies. This includes submitting their financial statements to the Portuguese tax authorities and undergoing audits if they meet the relevant size thresholds.

Non-compliance with these financial obligations can result in penalties, fines, and legal complications.

6. Penalties for Non-Compliance

Failure to maintain accurate financial records or submit annual financial statements on time can result in legal penalties, fines, or sanctions.

Non-compliance with mandatory audits can also expose the company to reputational damage and legal risks, as audits are vital for maintaining credibility and ensuring financial transparency.

By adhering to these financial and auditing requirements, companies in Portugal ensure their operations align with local regulations, maintain transparency, and support long-term business growth.

Hiring personnel in Portugal can be a smooth process, thanks to the country's skilled workforce and supportive recruitment landscape. The Portuguese labor market is diverse and characterized by a multilingual population, making it an attractive option for businesses looking to expand.

1. Skilled Workforce

Portugal boasts a highly skilled and multilingual workforce. With a strong emphasis on education and training, many Portuguese workers are fluent in multiple languages, including Portuguese, English, and Spanish. This linguistic diversity facilitates effective communication in multicultural work environments and is beneficial for international companies.

2. Professional Recruitment Agencies

Portugal is home to a number of professional recruitment agencies that specialize in various sectors. These agencies have a deep understanding of the local job market and can help businesses find qualified candidates tailored to their specific needs. Their expertise streamlines the recruitment process, making it easier for new ventures to secure the right talent.

3. Flexible Labor Market

The Portuguese labor market offers a range of employment contracts, including full-time, part-time, and temporary positions. This flexibility allows businesses to adapt their workforce according to project demands or seasonal variations, enhancing operational efficiency.

4. Digital Hiring Platforms

In Portugal, digital job portals and professional networking sites are widely used for recruitment. Posting job vacancies online enables companies to reach a broad audience, attracting both local talent and expatriates. This approach is particularly advantageous for startups aiming to establish a foothold in the market.

5. Labor Laws and Regulations

It is essential for businesses to be aware of Portugal's labor laws, which include regulations on non-discrimination, data privacy, and fair employment practices. Ensuring compliance with these laws is crucial to avoid potential legal issues. Consulting with local legal experts or HR professionals can help navigate the complexities of Portuguese employment regulations.

6. Wage Structure and Employee Rights

Portugal has a regulated minimum wage system and robust worker protection laws, ensuring fair compensation and rights for employees. Employers are also responsible for providing social security benefits, which include health care, unemployment, and pension contributions. This commitment to worker rights fosters a stable labor environment, although it may result in higher labor costs for businesses.

While some employers may find the regulatory framework and associated costs challenging, these measures reflect Portugal's dedication to maintaining a fair and equitable labor market.

For entrepreneurs considering the Portuguese market, a thorough understanding of labor laws, workforce planning, and budget management is essential for building a sustainable and successful business.

Overall, the combination of a skilled workforce and a supportive recruitment framework makes Portugal an excellent choice for companies looking to hire and grow.

Intellectual property protection in Portugal is crucial for businesses seeking to safeguard their innovations and maintain a competitive edge. Protecting intellectual property involves registering patents, trademarks, and copyrights with the Portuguese Institute of Intellectual Property (INPI). This formal registration establishes legal ownership and helps prevent unauthorized use or reproduction by competitors.

The registration process includes submitting detailed applications, which are subject to examination by the INPI. Once approved, businesses gain exclusive rights to their intellectual creations, which is key to fostering innovation and ensuring fair market practices.

To enforce these rights, businesses must remain vigilant against potential infringements. This may involve monitoring the market for unauthorized use of their intellectual property and taking appropriate legal actions if necessary. Strategies can include issuing cease and desist letters, engaging in mediation, or pursuing litigation to resolve disputes. By actively protecting their intellectual property, companies can safeguard their unique offerings in the Portuguese market.

In Portugal, obtaining the necessary permits and licenses is crucial for businesses to operate legally and efficiently. Different industries require specific authorizations, and it is essential for companies to understand the regulatory requirements that apply to their sector.

Most businesses need a general business license to start operating. However, certain sectors, such as healthcare, food service, construction, and transportation, have additional requirements. These may include health and safety inspections, environmental impact assessments, or obtaining industry-specific certifications.

It is important for companies to conduct thorough research to ensure compliance with all relevant regulations and permit requirements. Consulting with legal experts or industry professionals can provide valuable advice and ensure that all necessary licenses are obtained.

Maintaining accurate records of all permits and licenses is also vital. This documentation proves compliance during inspections or audits and helps avoid potential penalties or disruptions to operations. By managing their regulatory obligations effectively, businesses can avoid fines and operate smoothly within Portugal.

Prioritizing the protection of intellectual property and securing all required permits and licenses will enable businesses to successfully navigate the Portuguese market and focus on growth and innovation.

What are the types of companies I can register in Portugal?

The most common types are Sociedade por Quotas (Lda) and Sociedade Anónima (SA). There are also other forms like sole proprietorships and partnerships.

What is the minimum share capital required to register a company?

For an Lda, the minimum share capital is €1 per shareholder. For an SA, the minimum share capital is €50,000.

Do I need a legal representative in Portugal to register a company?

Yes, non-residents must appoint a legal representative in Portugal to handle legal and administrative matters.

What documents are required to register a company in Portugal?

Required documents include the company's articles of association, identification documents of shareholders and directors, proof of initial share capital deposit, and a certificate of incorporation for foreign companies.

How long does it take to register a company in Portugal?

The process typically takes between 1 to 2 weeks, depending on the completeness of the documentation and the workload of the Commercial Registry Office.

What are the costs associated with registering a company in Portugal?

Costs include name registration (€75), Commercial Registry fees (€360), notary fees (€100 - €200), and any legal representation fees.

Do I need a physical office in Portugal to register my business?

Yes, you need a physical address for your company, which can be a rented office or a virtual office.

What taxes will my company be subject to in Portugal?

Companies in Portugal are subject to corporate income tax, VAT, and social security contributions for employees.

Can I register a branch of a foreign company in Portugal?

Yes, you can register a branch of a foreign company by providing the necessary documentation, including the parent company's certificate of incorporation and articles of association.

Is it necessary to hire a local accountant for my business in Portugal?

While not mandatory, it is highly recommended to hire a local accountant to ensure compliance with Portuguese accounting and tax regulations.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!