House of Companies is thrilled to offer our clients cutting-edge bookkeeping services in Portugal. Our team of experts is equipped with the latest tools and technologies, enabling us to deliver innovative solutions tailored to meet your unique needs in the Portuguese market.

With advanced and next-level support, you can rest assured that your bookkeeping needs are in the best possible hands. Let's get started!

It's becoming simpler every day to deliver and process invoices, bank statements, and even agreements in Portugal. House of Companies simplifies the procedure of submitting your data using a single source for all documents, data, and reports. You can track our progress and your profits in real-time!

Automated OSS filing for import traders and e-commerce.

Close your fiscal year and generate financial statements with a click!

Ready to expand into Portugal and beyond? Run and build your business!

Ready to Expand into Portugal and Beyond? Manage Your Entity and Fuel Your Growth!

Delivering and processing invoices, bank statements, and agreements (such as your lease) is becoming increasingly straightforward. The House of Companies simplifies the submission of your data by providing a single source for all documents, data, and reports.

With our system, you can monitor progress and track your profits in real time!

Portugal has a comprehensive legal framework governing financial reporting, primarily based on the EU Accounting Directive 2013/34/EU and incorporated into the Portuguese Accounting Standardization System (Sistema de Normalização Contabilística, SNC). This framework is supplemented by the Portuguese Accounting Standards (Normas Contabilísticas e de Relato Financeiro, NCRF) issued by the Accounting Standardization Commission (Comissão de Normalização Contabilística, CNC), and International Financial Reporting Standards (IFRS) as adopted by the EU.

Entities with securities listed on a regulated market in the EU/EEA must comply with additional reporting requirements under the Portuguese Securities Market Code (Código dos Valores Mobiliários).

These requirements include publishing annual financial reports within four months of the end of the financial year and half-yearly financial reports within three months after the first six months of the financial year.

The annual financial reporting comprises the management report, audited financial statements, other information, and statements made by the management board attesting to the true and fair view presented by the financial statements and management report.

For corporate tax purposes, a Portuguese company with substance, i.e., a permanent establishment (PE), is subject to corporate income tax (IRC) on its worldwide income. In contrast, a non-resident company without a PE in Portugal is only liable for IRC on Portuguese-source income.

The term 'permanent establishment' is defined in the IRC Code and follows the definition in the applicable tax treaty for treaty situations. For non-treaty situations, the definition aligns with Article 5 of the OECD Model Convention.

Regarding value-added tax (IVA), a Portuguese company with substance must register for IVA and charge IVA on its supplies of goods and services.

A non-resident company without a PE in Portugal may still be required to register for IVA if it makes taxable supplies in Portugal, such as distance sales or e-services to non-IVA registered customers.

Non-resident entities seeking to establish a presence in Portugal have several legal entity options, each with its own set of accounting and tax implications. The most common types include branch offices, subsidiaries, and foreign legal structures.

A branch office is not a separate legal entity but an extension of the foreign company. It must be registered with the Portuguese Commercial Registry (Registo Comercial) and is subject to corporate income tax and value-added tax (IVA) on profits attributable to the branch.

Subsidiaries are independent legal entities incorporated under Portuguese law. They must register with the Commercial Registry, file annual financial statements, and comply with all Portuguese tax obligations, including corporate income tax, IVA, and wage tax.

Registering a branch office in Portugal involves several accounting obligations. The branch must maintain accurate books and records, and the foreign company's financial statements must be filed with the Portuguese tax authorities. If the branch employs staff, it is required to establish a Portuguese payroll system and withhold wage tax and social security contributions.

The branch office’s profits are subject to Portuguese corporate income tax, and the branch must file regular VAT returns, typically on a quarterly basis. Transfer pricing regulations apply to transactions between the branch and its foreign head office, requiring proper documentation to support the allocation of profits between the two entities.

The decision between establishing a branch office, subsidiary, or using a foreign legal structure depends on various factors, such as the scope of activities in Portugal, tax considerations, and administrative efficiency. Non-resident entities are advised to consult with legal and tax professionals to determine the best structure for their specific needs.

Non-resident entities operating in Portugal must comply with various tax registration requirements to ensure compliance with Portuguese regulations. These obligations include registering for value-added tax (IVA), payroll taxes, and corporate income tax, depending on the nature and extent of their business activities in the country.

IVA for businesses with IVA taxable transactions

Businesses engaged in IVA taxable transactions in Portugal are required to register for a Portuguese IVA number. This applies to both resident and non-resident companies supplying goods or services within the country.

The registration process involves submitting an application to the Portuguese Tax and Customs Authority (Autoridade Tributária e Aduaneira), providing necessary documentation such as proof of business incorporation and identification documents.

Once registered, companies must charge IVA on their supplies, file periodic IVA returns, and maintain proper records of their transactions. The standard IVA rate in Portugal is 23%, with reduced rates of 13% and 6% applicable to certain goods and services.

Understanding and complying with VAT regulations is crucial for businesses engaging in VAT-taxable transactions in Portugal. With Portugal’s standard VAT rate of 23%, businesses operating in the country must ensure proper VAT registration, accurate tax filings, and timely payments to remain compliant with local tax laws.

Our entity management services in Portugal offer comprehensive support to businesses handling VAT. From VAT registration to managing returns and compliance, our expert team is dedicated to providing seamless assistance, ensuring your business adheres to Portugal’s VAT regulations efficiently and without disruption.

Businesses employing staff in Portugal are obligated to register as an employer with the Portuguese Tax and Customs Authority and deduct payroll taxes from their employees' wages. Employers must file payroll tax returns and remit the withheld amounts to the tax authorities.

Resident companies in Portugal are subject to corporate income tax (IRC) on their worldwide income. The standard IRC rate is 21%, with reduced rates applicable to small and medium-sized enterprises. Companies must file annual IRC returns and make advance payments throughout the year.

Non-resident entities operating in Portugal are subject to various bookkeeping and financial reporting obligations under Portuguese law. These requirements are primarily governed by the Portuguese Commercial Code (Código Comercial) and the Portuguese Accounting Standardization System (SNC).

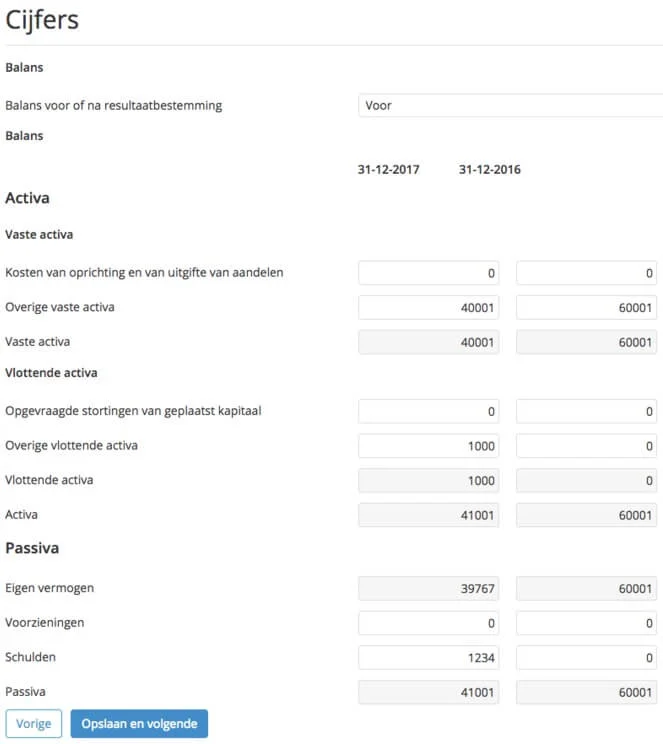

Content of Financial Statements typically includes:

Portugal's consolidation standards play a crucial role in the management of corporate entities, ensuring businesses comply with local financial and regulatory requirements. These standards are designed to maintain transparency and accuracy in financial reporting for companies operating within the country.

Our entity management services in Portugal are structured to assist businesses with meeting these consolidation requirements. We provide tailored support for financial reporting, group consolidation, and regulatory compliance, ensuring all company obligations are fulfilled efficiently. By focusing on Portugal’s specific legal framework, we ensure that businesses can operate seamlessly and with full compliance, allowing them to concentrate on growth and success.

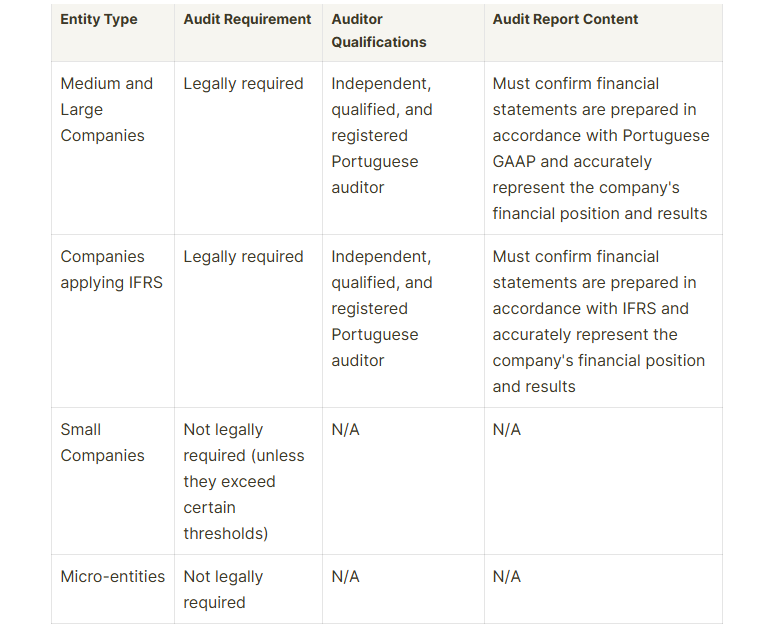

Only medium and large companies, as well as companies that apply IFRS, are legally required to have their annual report audited by an independent, qualified, and registered Portuguese auditor. The auditor’s report must confirm whether the financial statements are prepared in accordance with the accounting principles generally accepted in Portugal and accurately represent the company’s financial position and results for the year.

In Portugal, publication requirements play a vital role in ensuring compliance for businesses operating within the region. As part of our entity management services, we understand the importance of adhering to local regulations regarding the publication of company information.

Businesses in Portugal are required to submit certain documents to the Portuguese Official Gazette (Diário da República), ensuring transparency and legal compliance. These documents typically include the company’s articles of association, annual financial statements, and any changes in corporate structure. Meeting these publication obligations is essential for maintaining good standing with regulatory authorities and fostering trust with clients and stakeholders.

Our customer services are designed to assist businesses in Portugal with all aspects of publication requirements. We provide comprehensive support, helping companies prepare and submit the necessary documents accurately and on time. Our dedicated team ensures that businesses can focus on their core operations while we handle the intricacies of compliance in the Portuguese market.

Under Portuguese law, nearly all corporate entities are required to prepare financial statements in accordance with the entity's statutes, which are fundamental to the Portuguese legal system and corporate governance. These financial statements are also significant for taxation, as they serve as the basis for determining taxable income, although tax regulations have their own specific rules.

The content of the financial statements varies based on the company’s size and publication requirements but generally must include at least a balance sheet, an income statement, and explanatory notes. The financial statements should accurately reflect the company's financial position, and any changes in accounting policies must be disclosed in the notes.

Parent companies are typically required to include the financial data of "controlled subsidiaries" and other "group companies" in their consolidated financial statements. However, consolidation may be omitted under certain conditions, such as when a subsidiary or group company qualifies as a small company according to Portuguese statutory criteria or when the financial information has already been included in the parent company's consolidated financial statements prepared in compliance with the applicable accounting standards.

Online bookkeeping services have become a cornerstone for businesses seeking to streamline their financial operations. These services offer a comprehensive range of features tailored to meet the specific needs of startups and large enterprises alike. By leveraging technology and expertise, online bookkeeping providers deliver accurate financial reports and efficient management of financial data.

The expertise level of the virtual bookkeeping team is crucial in the Portuguese market. Many providers employ trained and qualified bookkeepers who understand the unique challenges of Portuguese businesses, including e-commerce and other industries. These experts are often certified in popular cloud accounting software like Primavera and SAP, as well as specialized accounting apps tailored for the Portuguese market. Their knowledge allows them to implement technology solutions that simplify accounting for Portuguese businesses, ensuring compliance with local tax laws and regulations.

Virtual bookkeeping services pricing in Portugal can vary significantly depending on the pricing model chosen by the business. Understanding these models helps Portuguese businesses make informed decisions about their financial management. Common pricing structures include:

Hourly rates: A traditional model where clients pay for the time spent on their bookkeeping tasks.

Monthly subscription fees: Provides clients with predictable monthly expenses for their bookkeeping needs.

Project-based pricing: Charges based on specific bookkeeping tasks or projects.

Value-based pricing: Focuses on the perceived value of services rather than the time or resources expended.

Factors influencing pricing in Portugal include the scope of services, company size, and the level of customization required. Portuguese businesses should be aware of potential hidden costs and look for providers that offer scalability in their pricing plans to accommodate growth.

Online bookkeeping services in Portugal typically offer a wide array of features designed to support businesses effectively:

Advanced features may include stock valuation services, implementation of control account reconciliations, and support for IVA returns across different regions of Portugal. Many providers also offer cloud-based solutions, ensuring round-the-clock access to financial data and enhanced security measures to protect sensitive information, all in compliance with Portuguese data protection laws.

By choosing the right online bookkeeping service, Portuguese businesses can benefit from increased efficiency, improved accuracy, and valuable insights into their financial health. This allows them to focus on core business activities while ensuring their finances are managed professionally and in full compliance with Portuguese regulations.

Industry-specific bookkeepers bring a wealth of knowledge that extends beyond basic accounting principles. They possess a deep understanding of sector-specific regulations, tax implications, and financial best practices relevant to various industries in Portugal. This expertise allows them to:

Value-based pricing: Charges are determined by the perceived value of services rather than the time spent, ensuring that businesses receive tailored solutions that match the importance of the service provided.

Tiered packages: Offering basic, standard, and premium options to accommodate different business needs and budgets.

Customized pricing: Pricing models are specifically adapted to meet the unique requirements of various industries and client needs.

This flexible pricing approach allows businesses in Portugal to access high-quality services that align with their financial constraints and specific industry demands.

Industry-specific bookkeepers in Portugal provide a range of features tailored to meet the unique challenges of various sectors:

These features enable Portuguese businesses to benefit from:

Virtual bookkeeping assistants have become an invaluable resource for businesses in Portugal seeking to streamline their financial management processes. These skilled professionals offer remote support, managing financial records, transactions, and reporting processes with efficiency and accuracy. By leveraging advanced accounting software and tools, virtual bookkeeping assistants handle a wide range of tasks, from data entry and reconciliations to payroll processing and expense tracking.

Virtual bookkeeping assistants in Portugal bring a wealth of knowledge and skills to the table. They possess a deep understanding of accounting principles and are well-versed in using various cloud accounting software platforms. Their expertise extends to managing balance sheets, delivering income statements, streamlining financial resources, and preparing custom reports. These professionals have the ability to work with a wide range of stakeholders, from customers to senior management, making them adept at managing complex relationships within the business ecosystem.

Many virtual bookkeeping assistants have extensive experience in their field, with some having worked in the industry for over a decade. They undergo regular training to stay updated on the latest accounting standards, tax regulations, and reporting requirements in Portugal. This ensures that businesses receive accurate and compliant financial services.

The cost of hiring a virtual bookkeeping assistant in Portugal can vary significantly based on several factors. Pricing models often include hourly rates, fixed monthly retainers, or project-based fees. Hourly rates for virtual bookkeeping assistants can range from EUR 10 to over EUR 50, depending on their experience and the complexity of the tasks involved.

For businesses looking for more consistent support, many virtual bookkeeping services offer monthly subscription plans. These plans often come in tiers, allowing companies to choose the level of service that best fits their needs and budget. Some providers offer flat rates for a certain number of hours worked per week or month, providing predictability in costs.

It's important to note that pricing can also be influenced by the virtual assistant's location. Assistants based in countries with lower costs of living, such as Portugal, often charge less than their counterparts in other parts of Europe, without necessarily compromising on quality.

Features of Virtual Bookkeeping Assistants in Portugal

Virtual bookkeeping assistants offer a comprehensive range of features designed to support businesses effectively. These include:

Before beginning the search for a virtual bookkeeping assistant, it's essential to clearly define the company's bookkeeping needs. Portuguese businesses must prepare financial statements that provide a true and fair view of their financial performance and position. These statements typically include a balance sheet, profit and loss account, and notes to the financial statements. Large and medium-sized companies are also required to publish management reports.

Companies should consider whether they need assistance with:

Enhanced Regulatory Adherence: Our accounting compliance services ensure that your business meets all local and international regulations, minimizing the risk of penalties and legal issues. We keep you updated on any changes in tax laws and compliance requirements, allowing you to operate confidently within the legal framework.

Improved Financial Accuracy: By implementing rigorous compliance practices, we enhance the accuracy and integrity of your financial reporting. This leads to reliable financial statements that reflect your business's true performance, supporting better decision-making and strategic planning.

Increased Operational Efficiency: Our streamlined compliance processes reduce the time and resources spent on managing accounting tasks. With our expertise, you can focus on your core business activities while we handle the complexities of compliance, allowing for more efficient operations and cost savings.

"The accounting team provided me with exceptional service. They took the stress out of tax season by preparing everything on time and ensuring I understood my obligations. Highly recommend!"

Maria S

Maria S"As a small business owner, I appreciate the personalized approach of their services. Their financial reports are clear and concise, helping me make informed decisions for my business."

Sofia P

Sofia P"Working with this accounting service has been one of the best decisions for my business. Their expertise in Portuguese tax regulations has given me peace of mind and confidence in my financial management."

Paulo N

Paulo N

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!