€995 . 00

per year

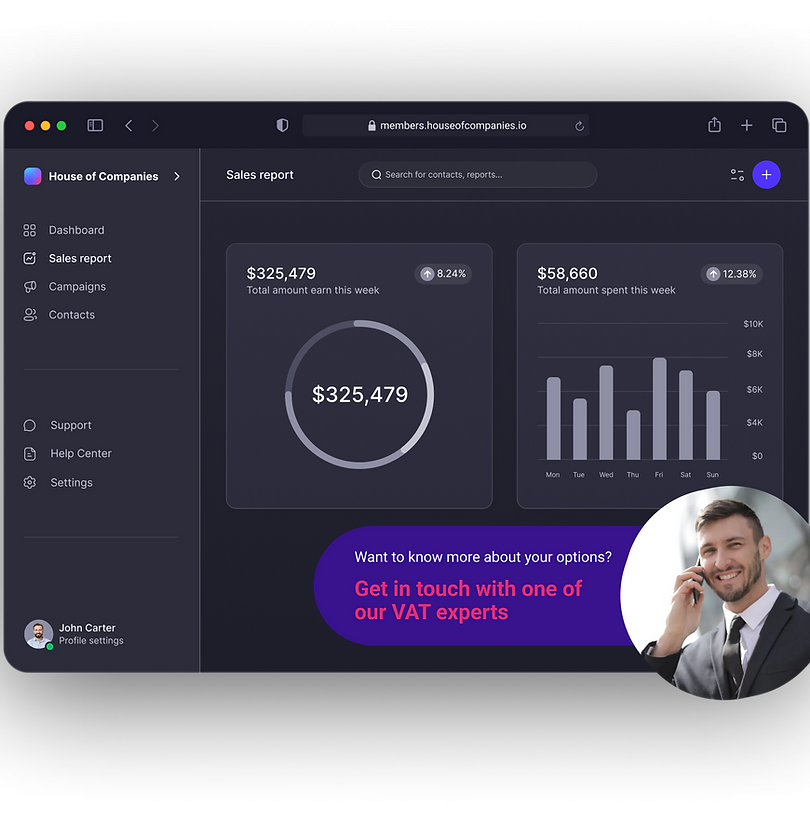

It's becoming simpler and simpler every day to deliver and process invoices, bank statements, and even agreements (such as your lease). The procedure of submitting your data is made simpler by House of Companies using a single source for all documents, data and reports. You can track our progress, and your profits, in real-time!

Your circumstance may actually call for the assistance of a Portuguese chartered accountant, despite the ever-expanding nature of tax and accounting playbooks and support. If you need help filing your tax return, House of Companies is here to help.

You can either send us your existing ledgers and IVA Analysis, or instruct us to draw up new ones from scratch.

In the process of establishing and scaling a Portuguese LLC, learning how to prepare Financial Statements in Portugal is crucial. It goes beyond legal compliance and is essential for transparency, financial health tracking, and decision-making. Financial statements, including the balance sheet, profit and loss account, and auditor's report, showcase fiscal responsibility and operational efficiency to shareholders, potential investors, and regulatory bodies.

This guide provides a structured pathway to prepare financial statements according to Portuguese regulations and standards. It covers gathering and compiling financial data, complying with Portuguese Generally Accepted Accounting Principles (GAAP), understanding legal entities and filing requirements, and the role of chartered accountants in Portugal. It also discusses the submission process, filing financial statements at the Commercial Registry (Conservatória do Registo Comercial), and preparatory work for Corporate Tax analysis and submission. The article includes insights into the simplified procedure for micro and small entities, filing deadlines, and digital submission tools. It serves as a comprehensive roadmap for Portuguese LLCs navigating the legal landscape of financial reporting.

To efficiently prepare financial statements for a Portuguese LLC, gathering and compiling financial data is a critical initial step. This process ensures accuracy and compliance with Portuguese accounting standards, ultimately reflecting the company's financial health.

Portuguese LLCs are required to prepare a comprehensive set of financial documents including the balance sheet, profit and loss account, and notes explaining these documents. For small entities, these statements need not be audited, but they must still provide a clear picture of the company's financial status.

The collection of financial data can be significantly enhanced by using advanced tools and software that automate and streamline the process. For instance, platforms that offer real-time ledger generation and tracking help maintain up-to-date financial information, promoting transparency and reducing the risk of misstatements. Additionally, tools that support the scanning and organized storage of documents facilitate the efficient extraction and processing of data, ensuring that all financial information is accurately captured and readily available for reporting.

In Portugal, the preparation of financial statements for a Portuguese LLC must adhere to specific standards to ensure transparency and compliance. These standards dictate the inclusion of the balance sheet, income statement, and, depending on the size of the company, the cash flow statement.

Balance Sheet

The balance sheet is a fundamental element of financial statements, providing a snapshot of the company's financial position at a given time. It includes assets, liabilities, and shareholders' equity, formatted according to the Portuguese Accounting Standardization System (Sistema de Normalização Contabilística, SNC), which specifies the layout for companies.

Income Statement

The income statement, or profit and loss account, details the company's financial performance over the financial year. It includes both realized and unrealized profits and losses, reflecting income from investments and operational activities. This statement also features distinct categories for dividends and taxes paid, which are specific to the Portuguese context.

Cash Flow Statement

For medium-sized and large companies, a cash flow statement is required and is considered a primary financial statement alongside the balance sheet and income statement. This statement categorizes cash flows into operating and investing activities, offering a detailed view of the company's liquidity and financial flexibility.

Leveraging modern technology, the House of Companies portal facilitates the real-time generation and tracking of financial statements. This platform integrates seamlessly with existing financial systems, allowing Portuguese LLCs to maintain accurate and up-to-date records. The portal supports the automation of the balance sheet and profit and loss account creation, ensuring compliance with Portuguese GAAP and reducing the risk of misstatements. This tool is invaluable for Portuguese LLCs looking to streamline their financial reporting processes and ensure accuracy in their financial disclosures.

Ensuring compliance with Portuguese Generally Accepted Accounting Principles (GAAP) is critical for Portuguese LLCs to maintain transparency and legal integrity in financial reporting. Portuguese GAAP, influenced by EU directives, sets a framework that mandates financial information to be understandable, relevant, reliable, and comparable.

Under Portuguese law, the financial statements must accurately reflect the company's financial position, presenting the equity at the balance sheet date and the profit for the year fairly and consistently. This includes a comprehensive balance sheet, profit and loss account, and explanatory notes. Specific valuation and disclosure requirements must be adhered to, ensuring that all financial reports provide insight into the company's solvability and liquidity.

Failure to comply with Portuguese GAAP can lead to significant consequences for Portuguese LLCs. Non-compliance may result in the rejection of the financial statements by auditors, legal penalties, or financial discrepancies reported to the authorities. This can affect the company's reputation and its ability to secure future financing or partnerships.

Directors hold a significant responsibility under Portuguese corporate law. They are required to ensure that all financial reporting complies with Portuguese GAAP. If directors fail in their duty of care, they may be held personally liable for any resultant damages to the company.

This includes scenarios where poor financial governance leads to bankruptcy or legal issues. Directors must act with due care and attention, as stipulated by the Portuguese Commercial Companies Code, to avoid personal liability.

The Input of a Chartered Accountant in Portugal, if Needed

In the intricate financial landscape of Portugal, the role of a chartered accountant, particularly in external auditing, becomes indispensable for Portuguese LLCs. These professionals, governed by stringent regulations and possessing specialized training, ensure that financial statements not only adhere to Portuguese GAAP but also present a true and fair view of the company's financial health.

Benefits of External Auditing and Scenarios When This is Useful

External auditing, conducted by certified accountants, is crucial for verifying the accuracy of financial statements against the International Financial Reporting Standards. Such audits provide an independent assessment, ensuring that the financial representations made by a company are both accurate and compliant with the required standards. This process is not only beneficial but often necessary to maintain transparency, enhance credibility, and uphold the integrity of financial reporting.

File and Publish Financial Statements at the Commercial Registry

To ensure regulatory compliance and transparency, Portuguese LLCs must file their annual financial statements with the Commercial Registry (Conservatória do Registo Comercial) in a timely manner. This process is crucial for maintaining the legal and financial integrity of the business.

Submission Deadlines

The board of directors is responsible for preparing the annual accounts within three months after the financial year ends. These accounts are then presented to the shareholders, who have three months to adopt them. Following adoption, the financial statements must be filed with the Commercial Registry within 15 days.

If the financial year aligns with the calendar year, the latest filing date without extension is typically June 30th.

Extending Deadlines and Exceptions

In exceptional circumstances, companies may request an extension for preparing the financial statements. However, if the accounts are not adopted within the allotted time, the unadopted accounts must still be filed.

To ensure compliance and accuracy in financial reporting, Portuguese LLCs must diligently prepare and submit their corporate tax returns. The process involves a series of critical steps, each designed to reflect the company's financial activities accurately over the fiscal year.

Corporate Tax Return Filing

Corporate taxpayers in Portugal are obligated to file their tax returns annually, with a general deadline set at the end of May following the end of the financial year. However, extensions can be requested if more time is needed to prepare accurate and comprehensive filings.

Calculation and Payment of Corporate Income Tax (IRC)

The calculation of IRC is based on the company's taxable profits, which may include adjustments such as loss carryforwards and carrybacks. The Portuguese tax authorities often issue a provisional assessment, which is adjusted after the final tax return is submitted.

Interest on IRC Payments

Interest on IRC due is calculated from the deadline for payment until the assessment is issued, with the current interest rate set by the Portuguese Tax Authority. If the IRC is paid late, additional penalties may apply.

Compliance and Audits

Portuguese LLCs may be audited by tax inspectors as part of the national tax authorities' monitoring tasks. This scrutiny ensures that all financial activities and tax filings are transparent and adhere to Portuguese regulations.

Filing Methods and Extensions

Corporate tax returns must be filed digitally. Companies have the option to manage this process in-house using approved software or outsource it to a tax service provider. For those needing more time, filing extensions can be applied for through the Portuguese Tax Authority's website or by submitting a form.

Avoiding Double Taxation

For foreign taxpayers earning income in Portugal, it's crucial to understand the implications of international tax treaties, which prevent double taxation on the same income. This ensures that companies are not unfairly taxed by multiple jurisdictions.

By following these guidelines and utilizing available resources, Portuguese LLCs can effectively manage their corporate tax obligations, ensuring compliance and contributing to their overall financial health.

[1] - https://www.houseofcompanies.io/

[2] - https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/audit/deloitte-nl-audit-annual-accounts-in-the-netherlands-2019.pdf

[3] - https://theaccountingjournal.com/netherlands/financial-reporting-in-the-netherlands/

[4] - https://online.hbs.edu/blog/post/how-to-prepare-an-income-statement

[5] - https://www.youtube.com/watch?v=aRL1MDYFMZ4

[6] - https://www.tax-consultants-international.com/publications/accounting-and-audit-requirements-in-the-netherlands

[7] - https://www.bnnlegal.nl/en/services/insolvency-law-and-bankruptcy/directors-liability-in-the-netherlands/

[8] - https://www.linkedin.com/pulse/7-reasons-conduct-external-audit-uae-atif-iftikhar

[9] - https://www.nba.nl/opleiding/foreign-auditors/ra-qualifications/the-dutch-educational-system-for-register-accountants/

[10] - https://www.kvk.nl/en/filing/when-do-i-have-to-file-my-annual-accounts/

[11] - https://www.kvk.nl/en/filing/am-i-required-to-file-annual-reports-and-accounts/

[12] - https://taxsummaries.pwc.com/netherlands/corporate/tax-administration

[13] - https://business.gov.nl/regulation/corporate-income-tax/

[14] - https://business.gov.nl/finance-and-taxes/business-taxes/filing-tax-returns/filing-your-corporate-tax-return-vpb-in-the-netherlands/

Engaging with Entity Management services in Portugal streamlines your business operations by ensuring compliance with local regulations and simplifying the complexities of financial reporting. These services offer expert guidance on corporate tax obligations specific to the Portuguese market, helping you navigate the intricacies of national and international laws while avoiding potential pitfalls.

By partnering with knowledgeable professionals, you can free up valuable time to concentrate on strategic growth initiatives, confident that experts are managing your administrative tasks. This not only enhances operational efficiency but also supports the long-term success and sustainability of your business in the competitive Portuguese landscape.

Ultimately, leveraging Entity Management services empowers you to focus on what truly matters: driving innovation and expanding your market presence while maintaining compliance with the evolving regulatory environment in Portugal.

"The annual financial statement preparation process in Portugal is straightforward when you have the right team. My clients appreciate the clarity and insights we provide, allowing them to make informed financial decisions with confidence."

Global Talent Recruiter

Global Talent Recruiter"Our annual financial statement preparation went smoothly, thanks to our accountant's professionalism. Their expertise helped us present a transparent report to our stakeholders, strengthening our credibility and trust."

Spice & Herbs Export

Spice & Herbs Export"The clarity and accuracy of annual financial statements prepared in Portugal are impressive. Having trustworthy accountants ensures that businesses are well-prepared for investment opportunities, making my job easier and more rewarding."

IT firm

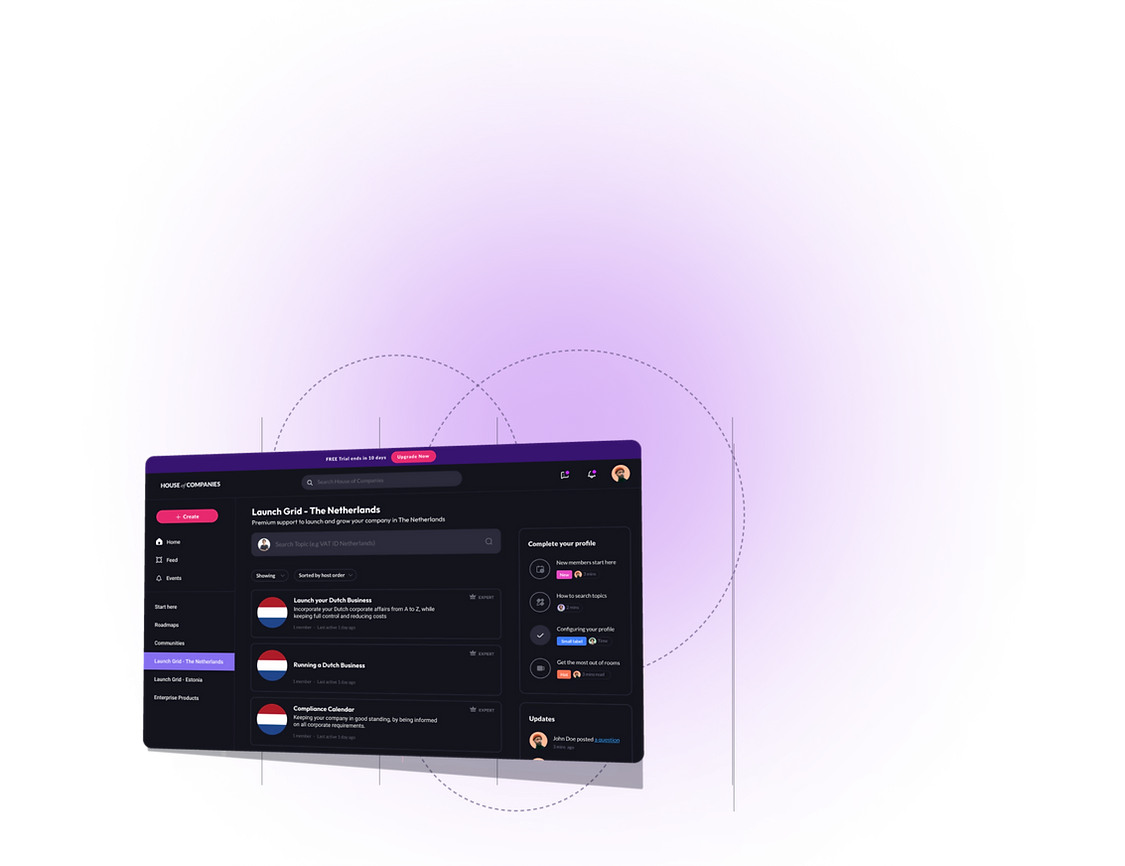

IT firmFeel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!