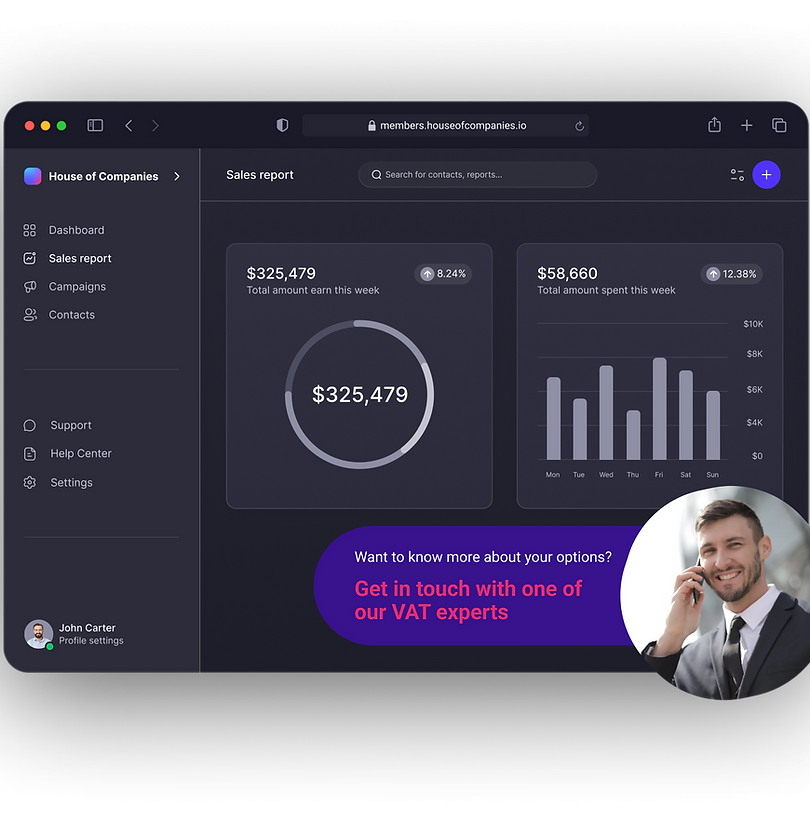

We are thrilled to offer our clients at House Companies the most comprehensive and cutting-edge bookkeeping services available in Portugal! Our team of experts is equipped with the latest tools and technologies, which enable us to deliver innovative solutions that are tailored to meet your unique needs. With advanced and next-level support, you can rest assured that your bookkeeping needs are in the best possible hands. Let's get started!

It's becoming simpler and simpler every day to deliver and process invoices, bank statements, and even agreements (such as your lease). The procedure of submitting your data is made simpler by House of Companies using a single source for all documents, data and reports. You can track our progress, and your profits, in real-time!

Automated bookkeeping systems streamline data entry, invoicing, and record-keeping, significantly reducing the time spent on manual tasks. This allows businesses to focus on core operations rather than getting bogged down by administrative duties.

With automated bookkeeping, businesses can access up-to-date financial information and reports at any time. This enables better decision-making based on current financial data, helping companies stay agile in a dynamic market.

Automation minimizes human error in data entry and calculations, leading to more accurate financial records. This is particularly important for compliance with Portuguese tax regulations, reducing the risk of costly mistakes during audits or tax filings.

"The team at House of Companies made understanding corporate tax compliance straightforward. Their guidance ensured we were fully compliant, allowing us to focus on growing our business."

Maria G

Maria G"House of Companies has been a vital partner in our tax compliance journey. Their knowledgeable team provided clarity in a complex regulatory environment, allowing us to focus on our sustainability goals."

James T

James T"The personalized support we received from House of Companies made all the difference. They took the time to understand our unique business needs and guided us through every step of the tax compliance process."

Emily R

Emily RYour circumstance may actually call for the assistance of a local tax professional, despite the ever-expanding nature of tax and accounting regulations. A local accountant may be required by law in certain situations in Portugal.

If you need help filing your tax return, House of Companies is here to help.

You can either send us your existing ledgers and IVA Analysis, or instruct us to draw up new ones from scratch.

Accountability compliance fosters transparency in business operations, which builds trust among stakeholders, including customers, investors, and employees. When a company adheres to regulations and ethical standards, it enhances its reputation, attracting more clients and partners.

Implementing accountability compliance measures helps identify and mitigate potential risks, such as legal issues or financial mismanagement. By proactively addressing compliance requirements, businesses can avoid costly fines, legal disputes, and damage to their reputation, ensuring long-term sustainability.

Establishing accountability compliance frameworks can streamline processes and standardize operations. This leads to improved efficiency, as employees understand their responsibilities and the procedures to follow, ultimately driving better performance and productivity within the organization.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

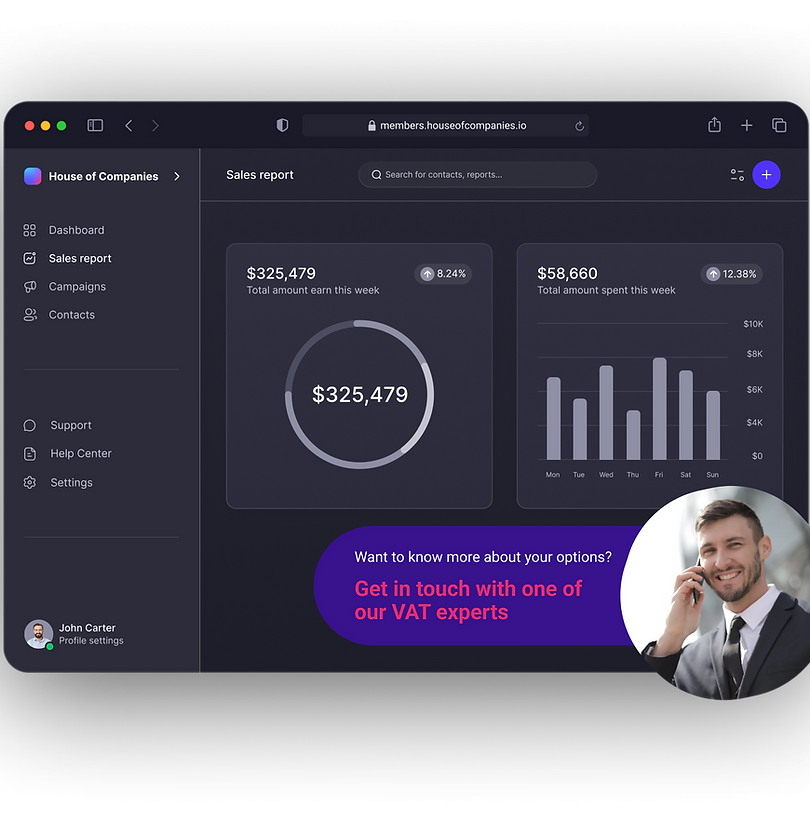

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!