VAT reporting in Portugal is an essential aspect of business compliance that demands careful attention to detail and a thorough understanding of local regulations. As part of our Entity Management services, we provide comprehensive support to ensure your VAT obligations are met accurately and on time.

Our Entity Management services assist businesses in streamlining their VAT reporting processes. We offer expert guidance on maintaining accurate records, preparing and filing VAT returns, and understanding the nuances of Portuguese VAT laws. Our team stays updated on any changes in legislation, ensuring your business remains compliant and minimizes the risk of audits.

It gets easier to send and manage bank records, bills, and even contracts like your lease every day. Entity Management Services gives you a central location to locate all of your papers, data, and reports, which makes sending in your data easy. Whether you're in Portugal or anywhere else, you can always keep an eye on our work and your sales!

Accurate VAT reporting ensures compliance with Portuguese tax laws and regulations, helping businesses avoid penalties, fines, and legal complications. Adhering to VAT obligations is crucial for maintaining a good standing with the Portuguese tax authorities.

Timely VAT reporting allows businesses to better manage their cash flow. By understanding when VAT is due and how much can be reclaimed, companies can plan their finances more effectively and avoid unexpected cash shortfalls.

Proper VAT reporting enhances a company's credibility and reputation. Clients, suppliers, and partners are more likely to trust businesses that comply with tax regulations and demonstrate transparency in their financial dealings.

Businesses that accurately report their VAT can reclaim input VAT on eligible purchases. This can lead to significant cost savings and improved profitability, especially for companies with substantial operating expenses.

Implementing a systematic approach to VAT reporting can streamline financial processes within a business. This includes improved organization of financial records, simplified reconciliation processes, and enhanced overall efficiency in accounting practices.

"Efficient bookkeeping has never been easier! House of Companies has helped us automate our processes, allowing us to save time and reduce errors significantly."

Miguel R

Miguel R"House of Companies transformed the way we manage our finances. Their bookkeeping services are efficient, precise, and have saved us countless hours. Highly recommend them!"

João M

João M"Thanks to the team at House of Companies, our bookkeeping is now streamlined and organized. Their attention to detail has made a significant difference in our financial reporting."

Maria F

Maria FYour circumstance may actually call for the assistance of a local tax professional, despite the ever-expanding nature of tax and accounting regulations. A local accountant may be required by law in certain situations in Portugal. If you need help filing your tax return, House of Companies is here to help. You can either send us your existing ledgers and IVA Analysis, or instruct us to draw up new ones from scratch.

Our accounting compliance services ensure that your business adheres to the latest Portuguese tax laws and regulations. This minimizes the risk of penalties or fines due to non-compliance, giving you peace of mind knowing your financial practices are legally sound.

We provide access to experienced accountants who are well-versed in Portugal's accounting standards and tax requirements. Their local expertise helps navigate complex regulations and ensures that your financial reports are accurate and reliable.

Our services streamline your accounting processes, improving overall efficiency. With accurate bookkeeping and timely reporting, you can make informed business decisions, track financial performance, and focus on strategic growth, all while leaving the compliance burden to us.

Learn More →

Learn More →

Learn More →

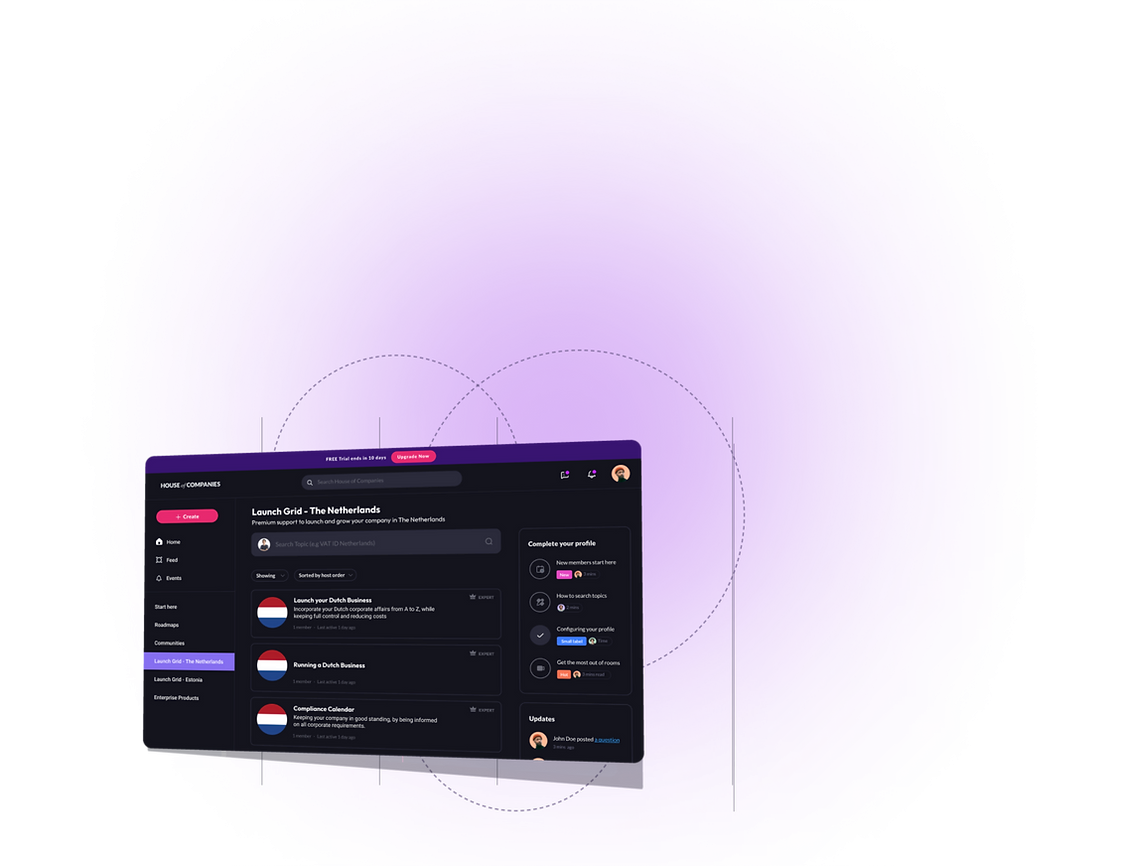

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!