Our simplified Entity Management services can help you manage your workers in Portugal more easily. It is the most cost-effective and efficient approach to conduct recruitment or relocation in Portugal, with no requirement for foreign tax lawyers or the establishment of a local organization. Let us handle your payroll and compliance issues.

With our Entity Management Portal, you can easily become an Employer of Record in Portugal, managing payroll and compliance issues without needing to set up a full-fledged business. Unlike other services that can cost over 600 EUR per month (e.g., Deel.com or Remote), Launch Grid provides a more cost-efficient solution. With our portal, you can reduce monthly payroll fees in Portugal to as low as 10 EUR per employee!

"The direct filing with Portuguese authorities through their platform made compliance a breeze. Highly recommended!"

Ana Rodrigues

Ana Rodrigues"House of Companies made payrolling our staff in Portugal incredibly simple. Their Entity Management Portal saved us time and money."

Maria Silva

Maria Silva"The support from the HR officers has been top-notch. They helped us understand our compliance obligations in Portugal thoroughly."

Ana Garcia

Ana GarciaIn some cases, a PEO could be a beneficial route for market entry or business expansion in Portugal. While Launch Grid has specific restrictions depending on your industry and the type of staff you plan to payroll, our community of PEOs can support your needs. You can find their services listed within our portal.

Learn More →

Learn More →

Learn More →

Here are Five FAQs related to payroll staff in Portugal:

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

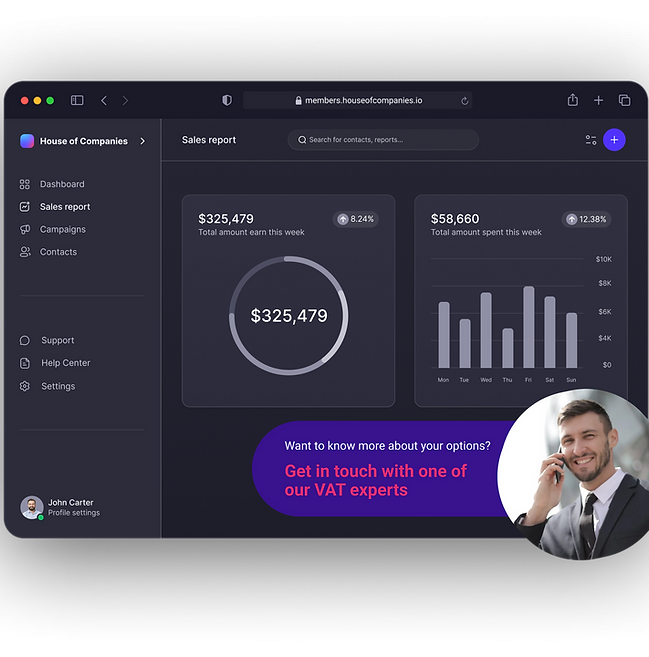

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!