Non-resident companies often face challenges when navigating the intricate accounting and tax regulations of Portugal. Portuguese accounting firms offer invaluable support to foreign businesses and individuals, managing their financial obligations while operating in the country. These firms play a pivotal role in ensuring compliance with Portugal's tax laws, from obtaining VAT numbers to filing annual reports. Their expertise is essential for foreign entities to fulfill their financial responsibilities and optimize their operations in the Portuguese market.

This guide explores the key aspects of accounting and tax compliance for non-residents in Portugal, highlighting how these practices have streamlined the financial landscape. Topics such as corporate income tax, bookkeeping requirements, and tax exemptions are addressed. With a clear understanding of these elements, non-resident companies can navigate their financial management in Portugal more effectively, seizing new opportunities and ensuring long-term success.

Navigating accounting and tax compliance can be a challenge for businesses, especially those with international operations. For both local and foreign entities, adhering to Portugal's regulations is critical to avoid penalties and ensure smooth business operations. Our Portuguese Accounting Services are designed to help businesses meet local requirements, covering everything from VAT registration to corporate tax filings.

Whether you’re a non-resident company entering Portugal or an established business, our tailored accounting solutions simplify compliance. We handle everything from financial reporting and statutory bookkeeping to corporate income tax filings, ensuring your business stays in line with Portuguese laws while optimizing potential benefits.

Our services do more than just keep your accounting practices aligned with Portuguese standards; they provide you with the confidence and peace of mind to focus on reaching your business goals without the burden of administrative tasks.

Our Portuguese accounting services are designed to optimize your profits by ensuring compliance and financial efficiency. Whether you're operating within the EU or expanding into non-EU markets, we focus on Portugal as the central hub for expert financial management.

With tailored solutions, we handle everything from VAT registration to corporate tax filings, ensuring your business meets all regulatory requirements while minimizing operational costs. This enables you to focus on growth while we manage the financial complexities.

Our entity management services go beyond Portugal, offering global support for businesses expanding into emerging markets. We ensure your corporate structure remains compliant, so you can operate with confidence in any region.

By partnering with us, you'll experience smooth international operations and financial stability. Our expertise in Portuguese accounting helps you maximize resources and seize opportunities, regardless of where your business operates.

Portugal's accounting regulations are designed to ensure transparency, accuracy, and compliance for businesses, whether local or international. The framework is built to promote financial integrity, with strict requirements for bookkeeping, timely submission of annual financial reports, and adherence to tax obligations.

Companies in Portugal must keep comprehensive records of all financial transactions and prepare their accounts according to Portuguese Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the company's size and classification. VAT compliance is also essential, with periodic filings required for both domestic and international transactions.

Corporate income tax filings are mandatory, with specific rules for deducting expenses and claiming tax credits. Failing to comply with these regulations can result in fines, which makes it crucial for businesses to stay well-informed about the latest updates in Portuguese accounting standards.

By aligning with Portugal's accounting regulations, companies ensure operational efficiency, avoid legal complications, and can leverage advantageous tax treatments outlined in the country’s legislation.

When expanding globally, including into non-EU countries, understanding legal entity types in Portugal is key. We offer comprehensive Entity Management services to guide non-residents in selecting the ideal structure for their business needs.

In Portugal, non-residents have various legal entity options, such as the Lda (Sociedade por Quotas), similar to a private limited company, or the S.A. (Sociedade Anónima), which is akin to a public limited company. Each type offers distinct advantages depending on the scale and nature of your business.

Our services simplify the entire process by providing expert advice on the best entity type for your specific needs, handling the registration process, and ensuring full compliance with local regulations. This includes everything from drafting articles of association to acquiring the necessary permits and licenses.

We also offer global support, assisting with entity setups not just in Portugal, but across a range of jurisdictions. This enables a seamless market entry while ensuring compliance in every region.

Choosing the right legal entity is essential to optimize your business operations and tax strategy. Allow us to guide you through these options to unlock your global success.

Registering a branch office in Portugal brings important changes to your accounting practices, and our global entity management services are designed to guide you through these adjustments for optimal compliance and efficiency.

Your branch must comply with Portuguese accounting standards, which involve maintaining comprehensive financial records and preparing annual financial statements. These practices ensure transparency and adherence to regulatory requirements.

You will also need to manage VAT registrations and periodic filings specific to Portugal. Properly handling these obligations is essential to avoid penalties and ensure smooth operations.

Our expert services simplify these accounting responsibilities, ensuring your branch office in Portugal stays compliant while enhancing financial management across regions, including those outside the EU.

Tax registration in Portugal is a vital step for businesses, including those from non-EU countries. Registering with Portuguese tax authorities ensures compliance and helps businesses operate seamlessly both within Portugal and internationally.

VAT for Businesses with VAT-Taxable Transactions

Companies engaged in VAT-taxable activities must obtain a VAT number in Portugal. This registration allows businesses to charge VAT on sales and reclaim VAT on purchases, following Portuguese VAT laws. Accurate VAT reporting and timely submissions are crucial to avoid fines and penalties.

Global Entity Management Services

Our global entity management services assist businesses in understanding and navigating Portugal's tax regulations, including VAT requirements. We guide companies from both EU and non-EU countries through the process of obtaining and managing their VAT registration, ensuring full compliance and optimizing their financial operations.

With our expertise, businesses can simplify their tax registration process, manage VAT obligations efficiently, and set the stage for successful growth in Portugal and globally.

To hire staff in Portugal, businesses must register as an employer with the Portuguese Tax and Customs Authority (AT). This registration ensures compliance with local payroll regulations and tax laws, enabling businesses to operate smoothly and legally.

Our global entity management services make this process seamless for companies, including those from outside the EU, with a focus on Portugal. We handle the entire registration process, from submitting the necessary documentation to managing ongoing payroll obligations, ensuring your business stays compliant with local requirements.

With our expertise, we take care of payroll and tax deductions for your Portuguese employees, allowing you to focus on what matters most: growing your business. We offer tailored solutions for businesses entering the Portuguese market or managing a global workforce, ensuring a streamlined and efficient experience.

Let us simplify your employer registration and payroll management, ensuring compliance while you expand your operations in Portugal and beyond.

Understanding corporate tax liability is crucial for resident companies operating in Portugal. Our global entity management services are designed to ensure full compliance with Portuguese tax regulations while supporting businesses from around the world, including non-EU countries.

We manage every aspect of corporate tax liability, from precise tax return filings to optimizing deductible expenses. With our expertise, we help you navigate the intricacies of Portugal's tax system, ensuring that your company stays in line with local laws while maximizing your tax benefits.

By focusing on Portugal's business-friendly tax environment, we help you take advantage of attractive incentives such as the non-habitual resident (NHR) tax regime, which offers significant advantages to qualifying individuals. Our tailored solutions minimize risk and improve your financial efficiency, so you can focus on expanding your business internationally.

Partnering with us means peace of mind, knowing that your corporate tax obligations are handled professionally, allowing you to concentrate on scaling your business with confidence.

For businesses in Portugal, whether established locally or operating internationally, including outside the EU, financial statements are a must and should typically include:

These documents must provide a true and fair view of the company’s financial health. It’s crucial to disclose the accounting methods applied, and any changes to these methods should be clearly justified and elaborated on in the notes. Adhering to Portuguese accounting standards guarantees transparency and offers stakeholders trustworthy financial insights.

In Portugal, parent companies are required to include financial data from "controlled subsidiaries" and other "group companies" in their consolidated financial statements. A "controlled subsidiary" refers to a company where the parent holds more than 50% of the voting rights or has the power to appoint or remove the majority of the directors.

Consolidation can be exempted if the subsidiary or group company qualifies as a small company under Portuguese law or if its financial information is already incorporated into the parent company’s consolidated statements, following the applicable Portuguese accounting standards. This ensures that stakeholders get a complete and accurate view of the group's financial health, in full compliance with local regulations.

For companies operating under Portuguese regulations, including those with global operations and non-EU subsidiaries, audit requirements are as follows:

Medium and Large Companies: These businesses must have their annual financial statements audited by an independent, qualified auditor registered in Portugal. The auditor will verify that the financial statements comply with Portuguese accounting principles and accurately represent the company’s financial health and performance.

IFRS-Adopting Companies: Companies applying International Financial Reporting Standards (IFRS) are also required to undergo an independent audit by a registered Portuguese auditor. This audit ensures adherence to IFRS and confirms the precision and reliability of the financial statements.

Audit Report: The auditor's report must affirm that the financial statements align with generally accepted accounting principles in Portugal and provide a true and fair representation of the company’s financial position.

Adhering to these audit requirements ensures transparency and credibility in financial reporting, providing confidence for businesses operating across borders and varying sectors.

In Portugal, ensuring transparency and compliance through the publication and filing of financial statements is a vital process for companies, aligning with EU regulations. Here’s an insightful look into the process:

Financial Statements: Companies in Portugal must disclose their financial statements, which include the balance sheet, profit and loss statement, and explanatory notes. These documents must offer a clear and accurate picture of the company’s financial position while adhering to the applicable accounting standards.

Disclosure of Accounting Principles: The financial statements must outline the accounting principles applied during the reporting period. Any changes to these principles must be thoroughly explained, with details on why the change was made and how it impacts the company’s financial health.

Consolidated Financial Statements: Parent companies are required to prepare consolidated financial statements that encompass the data of subsidiaries and group companies, except when specific exemptions apply. For example, if a subsidiary qualifies as a small entity under Portuguese law, it may not be required to include consolidated data.

Audit Report: Medium and large companies, as well as those using International Financial Reporting Standards (IFRS), must submit an audit report from an independent auditor based in Portugal. This report certifies that the financial statements align with Portuguese accounting standards and accurately reflect the company’s financial status.

These filing obligations in Portugal ensure companies fulfill legal requirements and provide stakeholders with accurate and reliable financial information.

For companies worldwide, including those outside the EU, filing annual accounts is a crucial requirement. Our entity management services ensure that your business complies with Portuguese regulations by preparing and submitting precise annual financial statements.

We oversee the entire filing process, from the balance sheet and profit and loss account to the accompanying notes, ensuring adherence to Portuguese accounting principles. This guarantees transparency and helps avoid penalties.

Our services also encompass consolidation requirements, ensuring that financial data from subsidiaries and group companies are accurately incorporated into your consolidated statements. We handle these obligations with expertise, regardless of your company’s international footprint.

By partnering with us, you ensure that your annual accounts are filed on time and in full compliance with Portuguese laws, offering peace of mind while you focus on expanding your business.

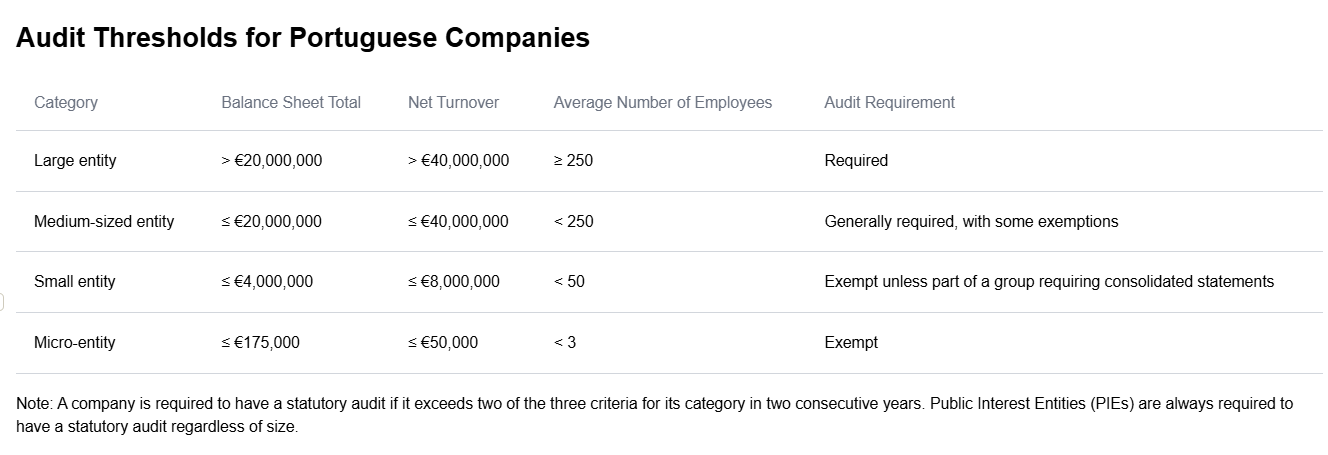

Non-resident entities operating in Portugal must adhere to specific audit regulations based on their size and structure. Under Portuguese law, medium and large companies, as well as those applying International Financial Reporting Standards (IFRS), are required to have their annual financial statements audited by an independent, qualified auditor.

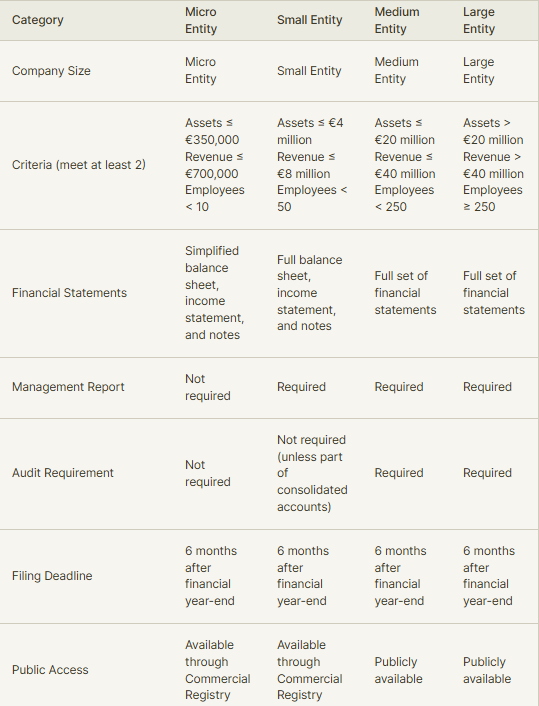

The classification of a company as medium or large depends on three key criteria: the value of its balance sheet assets, its net turnover, and the number of employees. A company meeting at least two of these conditions for two consecutive years is obligated to undergo a mandatory audit. This ensures that financial statements are prepared accurately and comply with Portuguese accounting standards.

The appointed auditor is tasked with producing a comprehensive report, evaluating whether the financial statements align with Portuguese accounting principles and whether they provide a true and fair view of the company's financial health and results. Furthermore, the auditor must confirm that the management board's report meets legal requirements and that sufficient supplementary information is included.

While non-resident entities may not always be subject to mandatory audits, they may still opt for a voluntary audit. This choice can boost the company’s reputation, facilitate access to financing, and strengthen overall risk management and compliance. A voluntary audit is a valuable tool for making well-informed strategic decisions and maintaining robust financial standing.

Alternatively, companies can opt for a review of their financial statements if a full audit is not required or desired. This review offers a limited level of assurance, ensuring the financial statements are accurate without the need for an in-depth audit. It provides a streamlined assessment of the company’s financial status, helping to maintain transparency and trust.

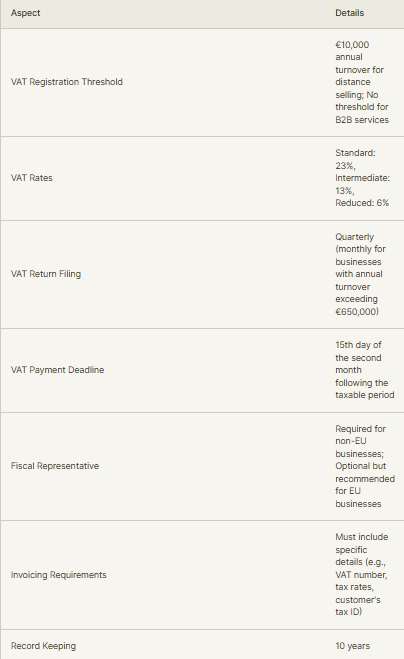

Portugal, renowned for its welcoming business environment, offers a streamlined VAT system for foreign companies looking to expand their operations within the country. Here’s an overview of the key VAT compliance factors that international businesses must consider when doing business in Portugal.

Foreign businesses must register for VAT in Portugal if their annual turnover surpasses €12,500, which is the threshold for mandatory registration. This relatively low limit ensures that most businesses are quickly integrated into the VAT system. However, businesses can also choose to voluntarily register for VAT before reaching the threshold to take advantage of reclaiming input VAT on their business expenses.

Portugal uses a standard VAT rate of 23% on most goods and services, making it one of the higher VAT rates in Europe. There is also a reduced rate of 13% for certain goods and services, such as restaurant meals, and a super-reduced rate of 6% for specific items like books, medicines, and public transportation. Businesses must file VAT returns quarterly, with larger companies required to submit returns on a monthly basis. The VAT payment deadline is the 15th of the month following the taxable period, providing a regular schedule for businesses to stay compliant.

For non-EU businesses, appointing a fiscal representative is a requirement, ensuring that the VAT obligations are properly managed and compliant with Portuguese tax regulations. This adds an additional layer of security for businesses entering the Portuguese market, ensuring both timely reporting and accurate payment handling.

This structured approach allows international companies to manage VAT requirements efficiently while benefiting from Portugal’s business-friendly policies.

Overview

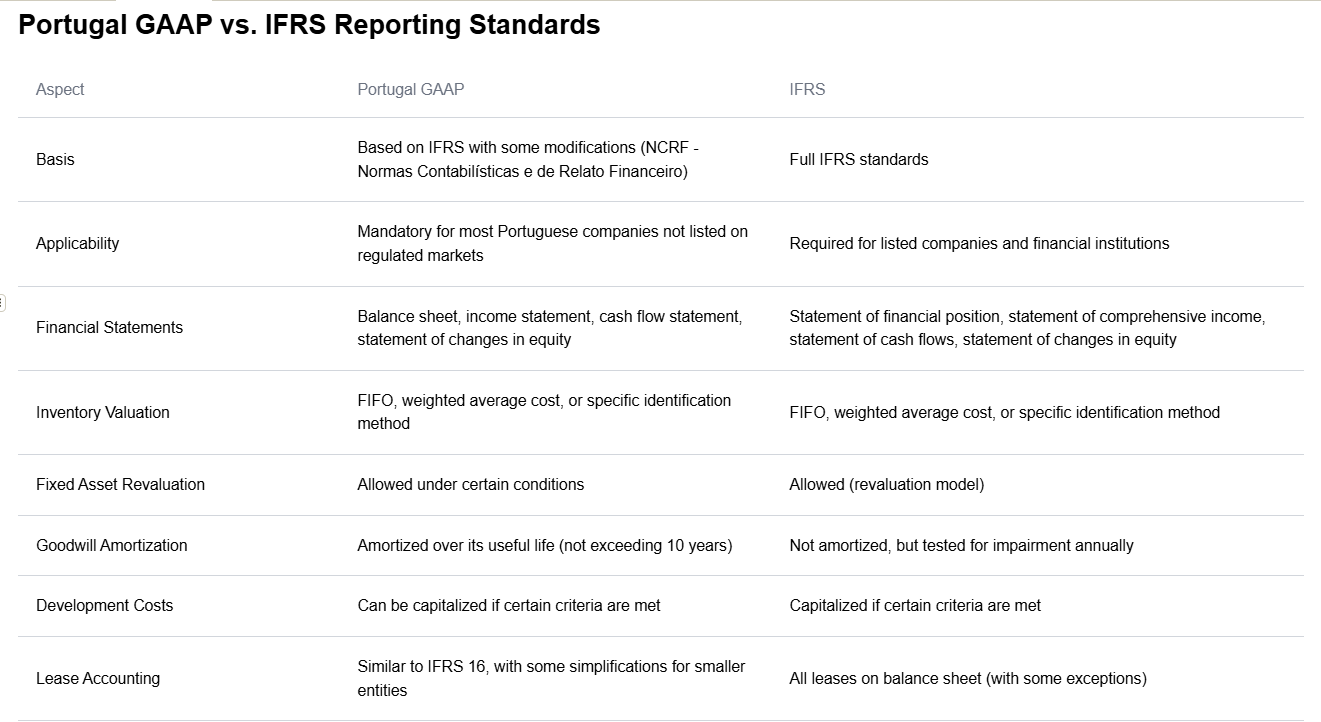

In Portugal, two primary financial reporting frameworks are used: Portuguese GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). Portuguese GAAP is based on IFRS for SMEs (Small and Medium-sized Entities) but includes adjustments tailored to the local context, while IFRS provides a globally recognized and more comprehensive set of standards.

Key Differences

Applicability: Portuguese GAAP is mandatory for most companies, especially small and medium-sized enterprises, offering a simplified framework. IFRS, on the other hand, is required for publicly listed companies and financial institutions, offering more detailed reporting standards that meet international expectations.

Financial Statements: Both frameworks demand similar financial statements, but the terminology and presentation slightly differ. Under Portuguese GAAP, companies will see traditional terms like "balance sheet" and "income statement," while IFRS uses "statement of financial position" and "statement of comprehensive income."

Accounting Treatments: There are key differences in how certain items are treated under the two frameworks:

Fixed Asset Revaluation: Portuguese GAAP does not allow the revaluation of fixed assets, whereas IFRS does.

Goodwill: Under Portuguese GAAP, goodwill is amortized over time, but under IFRS, goodwill is subject to annual impairment testing instead of amortization.

Development Costs: Development costs are generally expensed under Portuguese GAAP. In contrast, IFRS allows development costs to be capitalized if certain criteria are met.

Lease Accounting: Portuguese GAAP offers a more straightforward approach to lease accounting, whereas IFRS requires most leases to be recognized on the balance sheet.

These differences highlight the balance between Portuguese GAAP's simplicity and IFRS's global thoroughness, ensuring businesses can choose the right framework based on their size, structure, and international reporting needs.

In Portugal, corporations benefit from a distinctive tax system that encourages growth by only taxing profits when they are distributed. This system eliminates the typical withholding tax (WHT) on dividends, making it an attractive option for businesses looking to reinvest their profits.

When profits are distributed as dividends in Portugal, the corporation is subject to a 21% corporate income tax on the gross amount (equivalent to a 21/79 tax rate on the net distribution). This tax is paid by the distributing company itself, not withheld from the recipient, meaning that the individual or entity receiving the dividend is not subject to an additional withholding tax.

Portugal’s tax system offers several attractive benefits for businesses, including:

Reinvestment Exemption: Profits that are reinvested or retained within the company are not taxed. This exemption encourages companies to grow and expand without the burden of immediate tax liabilities, making Portugal an appealing destination for investment.

Reduced Rate for Regular Distributions: Portugal offers a reduced tax rate of 17% (17/83) on dividends distributed regularly, provided they meet specific criteria. This tax benefit incentivizes consistent profit sharing with shareholders.

Portugal has implemented anti-abuse provisions to prevent tax avoidance schemes. This includes ensuring that tax advantages are not exploited through artificial structures or by distributing profits to shareholders in low-tax jurisdictions. Portugal adheres to EU anti-abuse rules, particularly concerning cross-border distributions within the EU, ensuring that the tax system is not misused.

Portugal has signed several double taxation treaties with other countries. These treaties can offer reduced tax rates on cross-border dividends, but since Portugal’s tax is levied on the distributing company, the impact on the recipient is often minimal, depending on the terms of the specific treaty.

Portugal’s tax regime encourages businesses to retain and reinvest profits by taxing only distributed profits. This system fosters reinvestment and company growth, while offering reduced tax rates and exemptions for regular distributions. The transparent, business-friendly framework aligns with EU regulations, ensuring compliance while offering a competitive tax environment for companies looking to expand or operate in Portugal.

A foreign company with a branch in Portugal is not required to prepare separate financial statements for that branch. However, it may need to provide a stand-alone balance sheet and profit and loss account specifically for tax purposes. As a branch is not a distinct legal entity from its parent company, there are no withholding tax implications for transactions between the branch and the head office.

In Portugal, the branch’s profits are generally subject to corporate income tax only when they are distributed, in line with Portugal's tax system that focuses on taxing distributed profits. The branch must adhere to local tax filing requirements, ensuring that income and expenses related to its operations in Portugal are accurately reported for tax purposes.

Consolidated Financial Statements: When the parent company has control over its subsidiary, it is generally required to prepare consolidated financial statements. This includes integrating the financial position and results of both the parent company and its subsidiary, offering a unified view of the corporate group.

Control Definition: Control is typically defined as the ability to govern the financial and operating policies of the subsidiary to benefit from its activities. Control is usually demonstrated by owning more than 50% of the voting shares or having the power to influence key decisions.

IFRS vs. Portuguese GAAP: Depending on the size and nature of the company, the parent may report under Portuguese GAAP or IFRS. Both accounting standards mandate the consolidation of subsidiaries, though IFRS provides more comprehensive guidance on the consolidation process and handling of non-controlling interests.

Portuguese Financial Reporting Standards: Companies following Portuguese GAAP have specific guidelines for consolidation, including how to handle subsidiaries in the parent’s consolidated financial statements.

Assets and Liabilities: The subsidiary’s assets and liabilities are combined with those of the parent company in the consolidated balance sheet. This means the subsidiary’s financial items are included within the respective categories of the parent’s balance sheet.

Equity Representation: In the consolidated equity section, the parent company’s equity is shown alongside any non-controlling interests, if applicable, giving a clear picture of ownership and control.

Disclosure: Consolidated financial statements must include detailed disclosures about the subsidiary, such as its name, the country where it is incorporated, and the relationship between the parent and subsidiary.

Financial Performance: The profit and loss statement of the consolidated financials will reflect the subsidiary’s financial performance, ensuring a complete view of the corporate group’s overall profitability and activities.

Tax Compliance: The parent company must ensure that any profits repatriated from the subsidiary comply with Portuguese tax laws, particularly regarding the taxation of distributed profits, and adhere to any applicable tax treaties.

Audit Requirements: Depending on the size and complexity of the parent and subsidiary companies, audit requirements may be required for the consolidated financial statements to ensure compliance with the relevant accounting standards.

Understanding these aspects helps ensure that the subsidiary is correctly reflected in the parent company's balance sheet while maintaining compliance with both local and international regulations.

Failing to meet filing requirements in Portugal can result in penalties under the Portuguese Penal Code and the Commercial Code. Members of the management board may be personally liable for damages caused to third parties due to non-compliance, as stipulated by the applicable provisions in Portuguese law.

To avoid these penalties, non-resident entities operating in Portugal must stay vigilant about annual reporting deadlines and filing obligations. It's crucial to seek expert guidance to ensure full adherence to Portugal's accounting regulations and reporting requirements. Timely and accurate submissions not only help prevent legal penalties but also foster transparency and good governance within the company.

In Portugal, the audit requirements for companies are governed by the Portuguese Commercial Code and the Accounting Standards System. These requirements are based on specific financial thresholds and other criteria, categorizing businesses based on their size and various factors. Depending on the classification, companies may need a full audit, a limited review, or be exempt from external verification.

Here's a breakdown of the size criteria for each category of companies in Portugal:

Large Enterprises: Companies exceeding a certain threshold in terms of total assets, net turnover, or the number of employees typically require a full audit of their financial statements.

Medium Enterprises: Based on meeting specific size parameters, these companies might be subject to a more limited review or exempt from full audits.

Small Enterprises: Generally, small businesses with lower thresholds of turnover, assets, and employees are exempt from the audit requirements but still need to comply with basic accounting obligations.The classification depends on annual financial figures such as turnover, balance sheet total, and workforce size, guiding businesses toward the appropriate level of external assurance.

Under Portuguese law, only medium-sized and large companies are legally required to have their financial statements audited by an independent, qualified, and registered auditor in Portugal.

Micro and small entities are exempt from this requirement, and unaudited financial statements are sufficient for these smaller businesses.

The appointed auditor, selected by the general shareholders' meeting or, in case of default, by the supervisory or management board, must issue an audit report. This report should confirm whether the financial statements align with Portuguese accounting principles and accurately reflect the company’s financial position and performance for the year.

Non-resident entities operating in Portugal should be aware of these audit thresholds and obligations to ensure compliance with local regulations. Consulting with legal and accounting professionals can guide companies in determining the appropriate actions based on their size and specific operational needs.

All resident businesses, as well as non-resident entities with income generated in Portugal, must file tax returns.

Common tax returns include corporate income tax, VAT returns, payroll tax returns, and additional returns for certain industries, such as property tax or municipal taxes.

Corporate income tax returns must be filed by the end of May in the year following the tax year.

VAT returns are typically filed on a quarterly basis, but larger businesses may be required to submit monthly VAT filings.

Payroll tax returns, including social security contributions and employee withholdings, must be filed monthly.

Late filings can result in penalties, including fines and interest on unpaid taxes. Penalties vary depending on the type of tax and the length of the delay.

Yes, most tax returns can be filed electronically through the Portuguese Tax and Customs Authority’s online platform, “Portal das Finanças.”

Yes, businesses can take advantage of deductions for operational costs, R&D tax credits, and specific incentives for small and medium-sized enterprises (SMEs), among others.

Businesses are required to retain records of income, expenses, invoices, and other supporting documents for at least 10 years.

Businesses can consult with tax advisors, accountants, or utilize the resources available through the Portuguese Tax and Customs Authority’s online services.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!