We specialize in providing comprehensive services to assist e-commerce entrepreneurs in streamlining and automating the VAT return process, making selling within the Portuguese and European markets more seamless.

Your VAT and IVA returns automated from A to Z

Starting at 75 EUR p.m.

We provide comprehensive solutions for e-commerce entrepreneurs to streamline international sales in Portugal. By optimizing and automating the VAT (IVA) return process, we enable seamless expansion into new markets without the burden of complex tax compliance.

Our cutting-edge Document Scanning and Validation service ensures accuracy and efficiency in managing essential documentation for Portuguese tax authorities. Furthermore, our platform facilitates real-time VAT reporting tailored to the specific requirements of Portugal and other EU countries, empowering businesses to navigate international growth with confidence and ease.

Step 01

When filing your VAT return through the local Portuguese tax office (Autoridade Tributária e Aduaneira) in Portuguese, it can lead to incorrect VAT returns, resulting in fines, and consuming a significant amount of time to comprehend and process the requirements.

Step 02

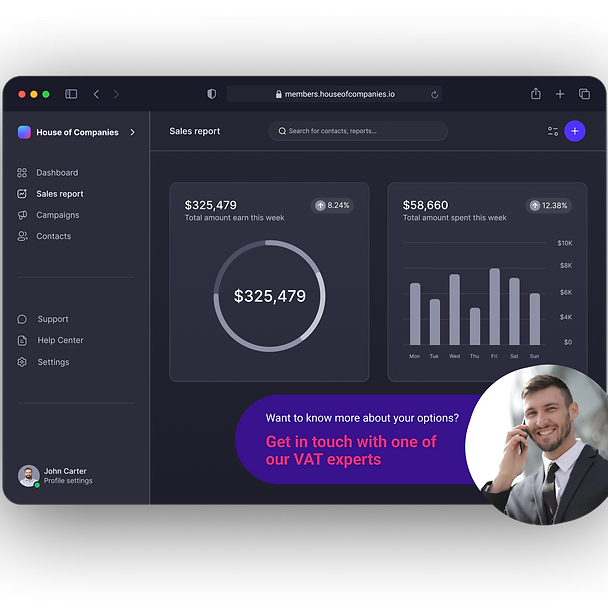

We provide real-time insights and complete VAT reports, ready for direct filing with the Autoridade Tributária e Aduaneira.

Step 03

All transactions and documents are connected via our Document Hub. Drill down to get into the details of your Portuguese VAT report.

Partnering with our VAT experts allows you to leverage the benefits of automation while receiving personalized support to navigate the intricacies of Portuguese VAT compliance. Contact us today to explore how our dedicated VAT support can elevate your automated VAT process and drive financial efficiency for your business in Portugal.

We understand the challenges businesses face in navigating the complex landscape of Portuguese VAT compliance. That's why we offer dedicated support from our team of VAT experts to complement your automated VAT process. With our specialized assistance, you can streamline your VAT compliance and reclaim processes while ensuring accuracy and efficiency in accordance with Portuguese regulations.

Comprehensive VAT Consultancy: Our team provides guidance on a wide range of VAT matters, from initial registration with the Autoridade Tributária e Aduaneira to cross-border transactions and complex issues such as control visits and assessments.

Tailored VAT Planning: We offer customized VAT planning advice, including structuring commercial property transactions to minimize the impact on cash flow in Portugal.

International VAT Guidance: Our specialists are well-versed in the complexities of VAT on international services and can navigate the rules and regulations governing international business transactions in Portugal and the EU.

Error Correction and Compliance: We help rectify VAT errors and ensure compliance with Portuguese VAT regulations, reducing the risk of penalties and problems.

Increased Visibility: Our experts provide ongoing visibility into the status of your VAT claims in Portugal and offer insights to enhance your compliance rates.

Guaranteed Compliance: We ensure that only accurate and compliant claims are filed with the Autoridade Tributária e Aduaneira, safeguarding your finances and minimizing the risk of fines.

Optimal Results: With our support, you can maximize your VAT reclaim potential in Portugal, leading to increased profitability for your business.

Partnering with our VAT experts allows you to leverage the benefits of automation while receiving personalized support to navigate the intricacies of Portuguese VAT compliance. Contact us today to explore how our dedicated VAT support can elevate your automated VAT process and drive financial efficiency for your business in Portugal.

"Their automated system made VAT compliance so much easier. Highly recommend their services."

Sarah J

Sarah J"Their platform is user-friendly and efficient. We were able to file our VAT returns quickly and without any issues."

John M

John M"The team was always available to answer our questions and provide support. Excellent service!"

Linda K

Linda KFeel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!