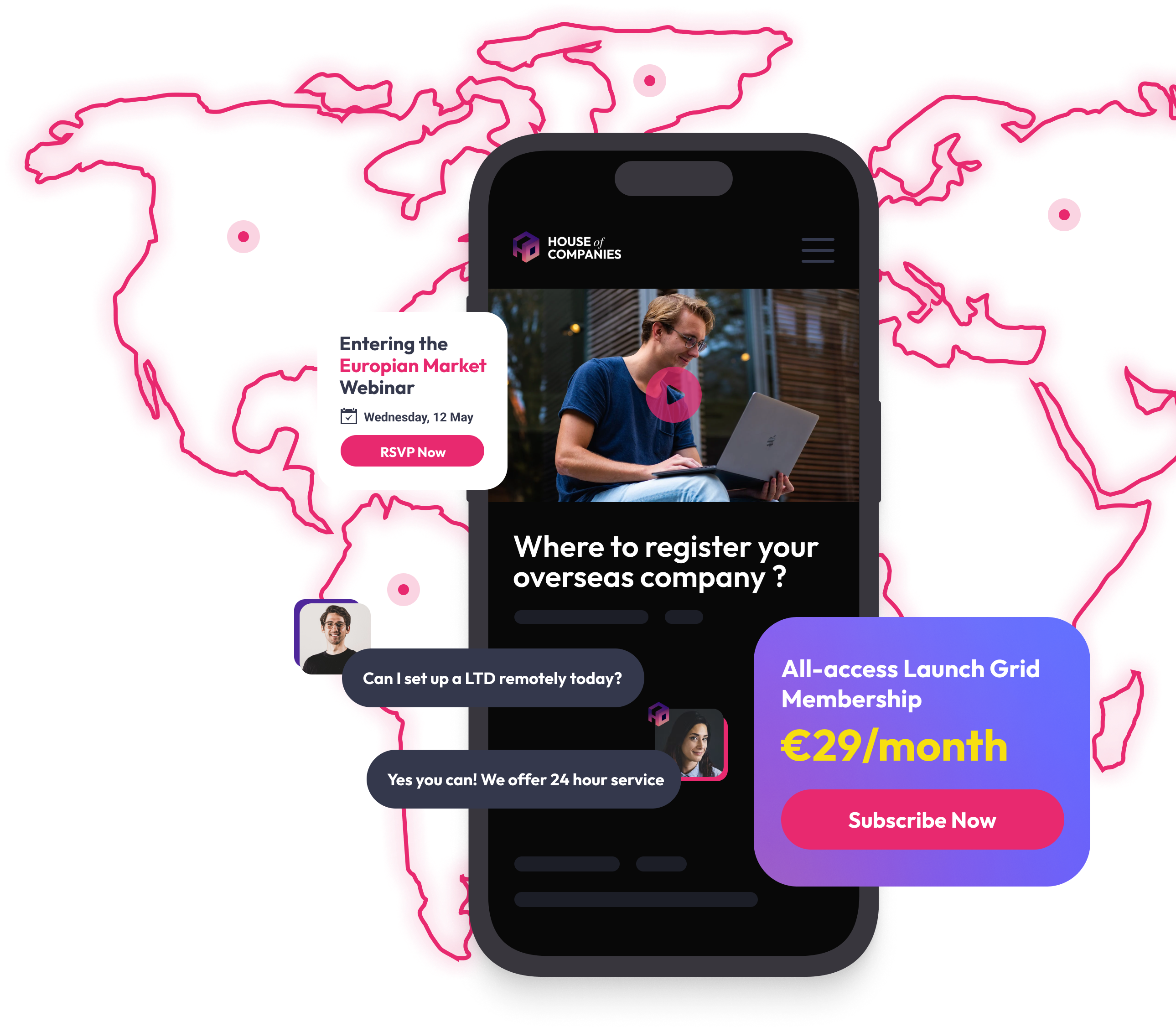

Effortlessly manage your international VAT compliance by obtaining a VAT number in Portugal. Whether you're a start-up expanding globally or an established business exploring the Portuguese market, we provide the knowledge and tools needed to simplify the VAT registration process and ensure compliance with confidence.

VAT can be complicated, especially when you trade overseas. We can help you to apply the One Stop Shop in Europe, the Reverse Charge Method, or obtain the Art.23 Exemption to avoid any VAT on your import.

At House of Companies, we strive to make the VAT registration and filing process as smooth and hassle-free as possible for global entrepreneurs like you. We offer two additional services that can further simplify your journey:

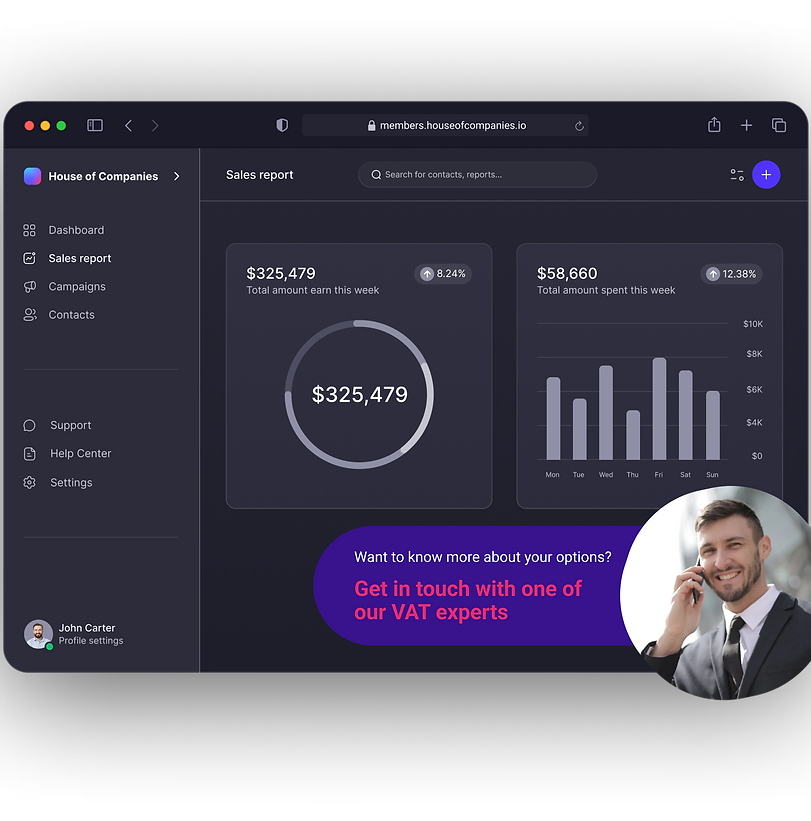

If you have specific questions or concerns about your VAT situation, our team of VAT experts can provide you with a customized Advisory Report. This report will offer insights and recommendations tailored to your business, helping you make informed decisions and optimize your VAT compliance strategy.

Enter house of companies, a game-changing platform designed to streamline and simplify the VAT registration process. This innovative business portal provides a one-stop solution for companies looking to expand their operations globally. By leveraging technology and a team of VAT experts, our services offer a seamless, user-friendly experience that breaks down the barriers of traditional VAT registration.

Our services provide expert guidance throughout the VAT registration process. With a team of VAT specialists available to answer questions and offer advice, we ensure that businesses stay fully compliant with VAT laws in their target countries. This expert support helps mitigate the risk of penalties and non-compliance, giving companies peace of mind as they expand their global operations.

Understanding Portugal VAT Regulations

Understanding VAT regulations in Portugal can be complex, but HouseofCompanies.io is here to simplify the process. Portugal's VAT system is governed by local government agencies, and compliance is crucial for businesses operating within the country. Our platform ensures that you are fully aware of the necessary steps and requirements for VAT registration in Portugal.

How We Support Our Clients

Expert Guidance: Our team of VAT specialists provides comprehensive support throughout the VAT registration process, ensuring compliance with Portuguese regulations.

Customized Advisory Reports: Receive tailored insights and recommendations specific to your business needs in Portugal.

Seamless Application Process: Utilize our business portal to apply for your VAT ID and manage your VAT compliance efficiently.

Direct Contact with Authorities: We facilitate direct communication with local tax authorities, streamlining the registration process.

Ongoing Support: Our VAT experts are available to answer any questions and provide ongoing advice to ensure your business remains compliant.

By leveraging House of Companies, businesses can navigate the complexities of VAT registration in Portugal with ease, allowing them to focus on their core operations and growth.

"Thanks to House of Companies, I got my VAT number quickly and without any hassle. Their expertise is a game-changer!"

Anna Polinski

Anna Polinski"I highly recommend House of Companies for VAT registration in Portugal. They made the process seamless and efficient!"

Sofia

Sofia "The team made my VAT registration a breeze. Their guidance was clear and effective!"

Yuki

Yuki

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!