Introduction

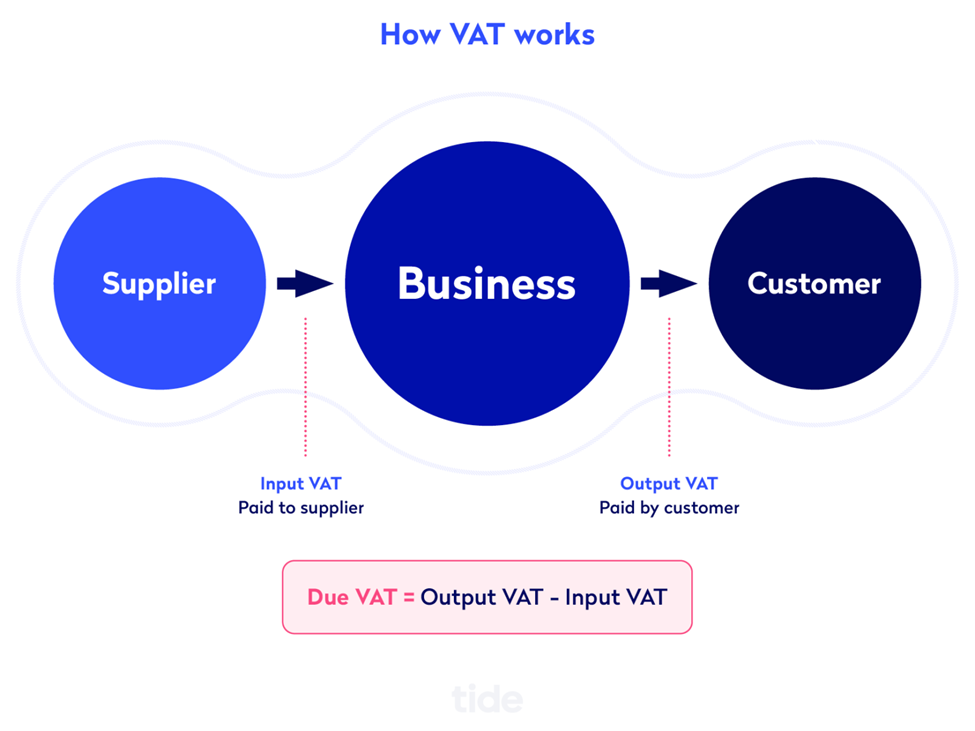

Value Added Tax (VAT) is a consumption tax imposed on goods and services at each stage of the supply chain. It is a common tax system used by many countries around the world, including the European Union. VAT returns, on the other hand, are periodic reports that businesses are required to submit to tax authorities, detailing their VAT liabilities and claims.

In most jurisdictions, businesses are obligated to register for VAT if their annual turnover exceeds a certain threshold. This requirement applies regardless of whether the company has engaged in any trading activities. VAT registration brings with it certain responsibilities, including the filing of VAT returns, even if no trading has taken place.

The purpose of VAT returns is to report the amount of VAT collected from sales and the amount of VAT paid on purchases. By submitting these returns, businesses provide transparency to tax authorities and ensure compliance with the applicable regulations.

It’s important to note that VAT regulations can vary from one country to another, so it is crucial to familiarize yourself with the specific requirements of your jurisdiction. Failure to comply with VAT obligations can result in penalties and fines, so it’s always best to seek professional advice to ensure compliance.

VAT registration requirements

As mentioned earlier, the obligation to register for VAT is typically triggered by surpassing a certain turnover threshold. This threshold can vary significantly depending on the country. For example, in the United Kingdom, the threshold is £85,000 for the tax year 2021/2022.

It’s worth noting that the turnover threshold is not solely based on sales revenue. It may also include other taxable supplies, such as goods and services provided to related parties or non-business activities that are subject to VAT.

If your turnover exceeds the registration threshold, it is important to register for VAT within the prescribed timeframe. Failure to register on time can result in penalties, and you may also be required to pay the VAT that should have been charged on your sales from the date you should have registered.

Trading activities and VAT obligations

Traditionally, the requirement to file VAT returns has been associated with businesses that engage in trading activities. This includes the buying and selling of goods or services for commercial purposes. However, as mentioned earlier, VAT obligations go beyond simple trading activities.

In some jurisdictions, certain activities that are not considered traditional trading may still fall within the scope of VAT. For example, if your company leases commercial property, provides consultancy services, or engages in other non-trading activities, you may still be required to register for VAT and file VAT returns.

The key factor to consider is whether these activities fall within the definition of taxable supplies under the VAT regulations of your jurisdiction. Taxable supplies are typically defined as the provision of goods or services for consideration, which can include both monetary and non-monetary transactions.

To determine whether your non-trading activities are subject to VAT, it is advisable to consult with a tax professional who is familiar with the specific regulations in your jurisdiction.

VAT return filing obligations

Once you have registered for VAT, you will have ongoing obligations to file VAT returns, regardless of whether your company has engaged in any trading activities. The frequency of VAT return filings can vary depending on your jurisdiction, but it is typically done on a quarterly basis.

The VAT return will require you to report the total value of your sales and purchases during the relevant period, as well as the amount of VAT charged and paid. This information is used to calculate your VAT liability or refund, depending on whether you have collected more VAT than you have paid or vice versa.

Filing VAT returns accurately and on time is crucial to maintain compliance with VAT regulations. Late or incorrect filings can result in penalties and additional scrutiny from tax authorities. It is therefore recommended to keep accurate records of your sales and purchases and seek professional advice if you are unsure about any aspect of the VAT return filing process.

Exceptions to filing VAT returns

While the general rule is that VAT-registered businesses are required to file VAT returns, there may be certain exceptions or special circumstances where filing is not necessary.

One common exception is the VAT flat rate scheme, which is available in some jurisdictions. Under this scheme, businesses pay a fixed percentage of their turnover as VAT instead of calculating the actual VAT charged and paid. In such cases, businesses may not be required to file detailed VAT returns but instead submit simplified returns based on the flat rate scheme rules.

Additionally, there may be certain exemptions or reliefs available for specific types of transactions or industries. For example, some countries offer VAT exemptions for certain medical services or educational activities. These exemptions may relieve businesses from the obligation to charge and report VAT on these specific transactions.

It is important to familiarize yourself with the specific exemptions and reliefs that may be applicable to your business and seek professional advice to ensure compliance.

Consequences of not filing VAT returns

Failure to comply with VAT return filing obligations can have serious consequences for your business. Tax authorities take non-compliance with VAT regulations seriously and may impose penalties, fines, or even criminal charges in severe cases.

Penalties for late filing or non-filing of VAT returns can vary depending on the jurisdiction and the severity of the non-compliance. In addition to financial penalties, tax authorities may also charge interest on any outstanding VAT liabilities.

Repeated or deliberate non-compliance with VAT obligations can also lead to increased scrutiny from tax authorities, which can result in audits and investigations. These processes can be time-consuming, costly, and potentially damaging to your business’s reputation.

To avoid these consequences, it is crucial to prioritize VAT compliance and ensure timely and accurate filing of VAT returns. Seeking professional advice can help you navigate the complexities of VAT regulations and minimize the risk of non-compliance.

Non-trading companies and VAT obligations

As mentioned earlier, even if your company has not engaged in any trading activities since incorporation, you may still have VAT obligations. This is because the requirement to file VAT returns is not solely dependent on trading activity.

If your company is registered for VAT, you are generally still required to file VAT returns, regardless of whether there have been any sales or purchases during the relevant period. The rationale behind this requirement is to ensure that businesses remain compliant with VAT regulations and fulfill their reporting obligations.

However, it is worth noting that some jurisdictions may offer options for non-trading companies to apply for a temporary exemption from VAT registration or filing obligations. These exemptions are typically granted if the company can demonstrate that it has no intention of engaging in any taxable activities in the foreseeable future.

If you believe that your company falls under the category of a non-trading company and qualifies for an exemption, it is advisable to consult with a tax professional to understand the specific requirements and procedures in your jurisdiction.

Impact on future trading activities

While it may seem burdensome to file VAT returns when your company is not engaged in any trading activities, it is essential to consider the potential impact on future business operations.

By maintaining your VAT registration and filing obligations, you ensure that your company is in compliance with the applicable regulations and ready to commence trading activities when the time comes. It can also help you maintain a good standing with tax authorities and avoid penalties or delays in obtaining necessary permits or licenses.

Furthermore, VAT registration can provide certain benefits, such as the ability to recover VAT on business expenses and the ability to issue VAT invoices to customers. These benefits can be valuable once your company starts trading and can help improve your cash flow and competitiveness in the market.

Therefore, even if your company is currently not engaged in any trading activities, it is often advisable to maintain your VAT registration and fulfill your filing obligations to ensure a smooth transition into active business operations.

Seeking professional advice

VAT regulations can be complex and vary significantly from one jurisdiction to another. It can be challenging for business owners to navigate these regulations and ensure compliance, especially when no trading activities are taking place.

To ensure that you fully understand your VAT obligations and fulfill your filing requirements, it is highly recommended to seek professional advice from a tax specialist or accountant who is familiar with the specific regulations in your jurisdiction.

A tax professional can assess your specific circumstances, provide guidance on VAT registration and filing obligations, and help you navigate any exemptions or reliefs that may be applicable to your business. They can also assist you in maintaining accurate records and ensure that your VAT returns are filed correctly and on time.

By investing in professional advice, you can minimize the risk of non-compliance, avoid penalties, and focus on growing your business with confidence.

Conclusion

The requirement to file a VAT return is not solely dependent on whether your company has engaged in any trading activities. VAT registration and filing obligations are triggered by exceeding the turnover threshold set by your jurisdiction, regardless of whether sales or purchases have been made.

While it may seem burdensome to file VAT returns when no trading activities are taking place, it is important to prioritize compliance with VAT regulations to avoid penalties and ensure a smooth transition into active business operations.

Seeking professional advice is crucial to understanding your specific VAT obligations, exemptions, and reliefs. A tax specialist can guide you through the complexities of VAT regulations and help you maintain compliance with the applicable requirements.

Remember, even if your company is not currently engaged in any trading activities, maintaining your VAT registration and fulfilling your filing obligations can provide benefits and position your business for future success.