In Portugal, a notary plays a crucial role in the company formation process, ensuring all legal requirements are met and that incorporation documents are properly executed. Here’s a breakdown of the notary's responsibilities:

Document Verification: The notary is responsible for verifying the authenticity of key documents required for company formation, such as the Articles of Association and identification details of the founders and board members.

Execution of the Notarial Deed: To legally establish a company in Portugal, a notarial deed of incorporation is necessary. The notary prepares and executes this document, ensuring it includes important details like the company name, registered office, share capital, and the identities of the founders and board members.

Legal Compliance: The notary ensures that the company’s Articles of Association and other incorporation documents meet Portuguese corporate laws. This includes checking that the company name is unique and confirming that share capital requirements are fulfilled.

Registration Support: Once the notarial deed is executed, the notary submits the relevant documents to the Portuguese Companies Register. This step is crucial for the company to be officially recognized.

Advisory Role: In addition to administrative duties, notaries provide legal advice throughout the company formation process, guiding founders through their rights and obligations under Portuguese law.

In essence, the notary serves as a vital legal intermediary, ensuring that the company formation process in Portugal is smooth, legally compliant, and seamless. This ensures that founders can move forward with confidence in establishing their business.

To register your company in Portugal, follow these simple steps for a seamless incorporation process:

Choose a Unique Company Name: Ensure your company name is distinctive and not similar to existing businesses. It must be professional and not misleading.

Prepare Key Documents: Gather the required documentation, including the Articles of Association, founders' agreement, proof of address, and identification documents for all company founders.

Open a Bank Account: Set up a business bank account to deposit the minimum share capital. For a private limited company (Lda.), the required minimum capital is €5,000.

Notarize Documents: Have your incorporation documents notarized at a notary's office. All founders must be present or may grant a power of attorney for this step.

Submit Your Application: File your company registration application with the Portuguese Commercial Registry. This can be done online through the official portal for a faster process.

Pay the Registration Fee: Ensure that you pay the necessary state fees, which will depend on the type of company and registration method.

Wait for Approval: Your application will be processed by the Business Registry, typically taking only a few days.

Receive Your Registration Number: Once your company is approved, you'll receive a unique registration number used for all legal and official matters.

Register for Taxes: Complete the tax registration with the Portuguese Tax and Customs Authority (Autoridade Tributária) within 60 days of your company’s formation.

Set Up Accounting: Organize your accounting system either in-house or by hiring an accounting professional to ensure your company complies with local financial regulations.

By following these steps, you'll successfully launch your business in Portugal while ensuring full compliance with all legal requirements.

In Portugal, the minimum share capital required to establish a private limited company, known as Sociedade por Quotas (LDA), is €5,000. This ensures the company has a solid financial base to support its initial operations and obligations. The share capital can be contributed in cash, or in some cases, as non-monetary assets, as long as they are valued and accepted by the company.

The share capital must be fully paid before the company can be officially registered with the Portuguese Companies Registry. This involves transferring the amount to a company bank account. Once the deposit is made, the bank provides a certificate confirming the payment, which is submitted during the registration process. This step is crucial as it shows the company's financial commitment and readiness to start operations.

While €5,000 is the minimum requirement, many entrepreneurs opt to contribute a higher amount to enhance the company's financial stability and provide additional resources for business growth. A higher share capital can also improve the company’s credibility with potential clients, investors, and partners, signaling a stronger financial position. Ultimately, the share capital should reflect the company’s business goals and financial strategy.

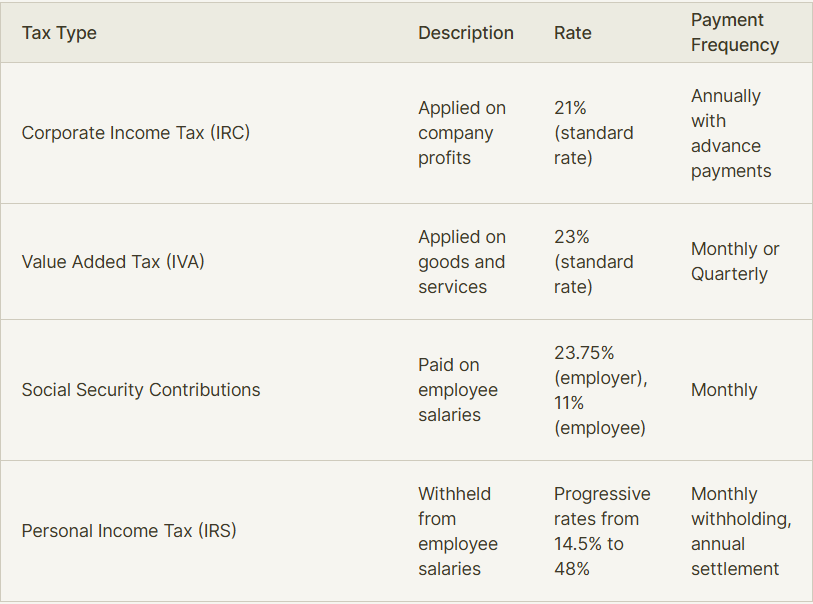

Corporate Income Tax (IRC)

Value Added Tax (IVA)

Social Security Contributions

Personal Income Tax (IRS)

This information provides a general overview of the main taxes in Portugal. Keep in mind that tax laws can change, and there may be specific rules, deductions, or exemptions that apply to different situations. For the most up-to-date and personalized tax advice, it's always best to consult with a qualified tax professional or the Portuguese Tax Authority (Autoridade Tributária e Aduaneira).

A private limited company (LDA) in Portugal must meet several key compliance obligations to stay legally sound and ensure smooth business operations. Here are the essential requirements for companies to adhere to:

Annual Report: Every Lda. is required to submit an annual report to the Portuguese Commercial Registry. This report must include the financial statements and be filed within six months of the end of the company’s financial year.

Accounting Records: The company must keep accurate, up-to-date accounting records in line with Portuguese accounting standards. This involves recording all financial transactions and preparing the required financial statements.

Tax Filings: Timely tax filings are a must, including Value Added Tax (VAT) returns if applicable and corporate income tax on distributed profits. These filings are generally done quarterly or annually, depending on the company's tax profile.

Employment Regulations: If the company employs staff, it must follow Portugal’s employment laws. This includes registering employees with the Portuguese Tax and Customs Authority, withholding and remitting personal income tax, and paying social security contributions.

General Meetings: An annual general meeting (AGM) must be held to discuss and approve the annual report, financial statements, and other key company matters.

Company Updates: Any changes in the company’s details, such as changes to the board of directors, registered address, or share capital, must be updated promptly with the Portuguese Commercial Registry.

Legal Compliance: The company must adhere to all applicable legal and regulatory requirements, including those related to data protection, environmental laws, and any industry-specific regulations.

By meeting these ongoing compliance requirements, a private limited company (Lda.) in Portugal ensures it operates within the legal framework and maintains transparency and accountability in its business practices.

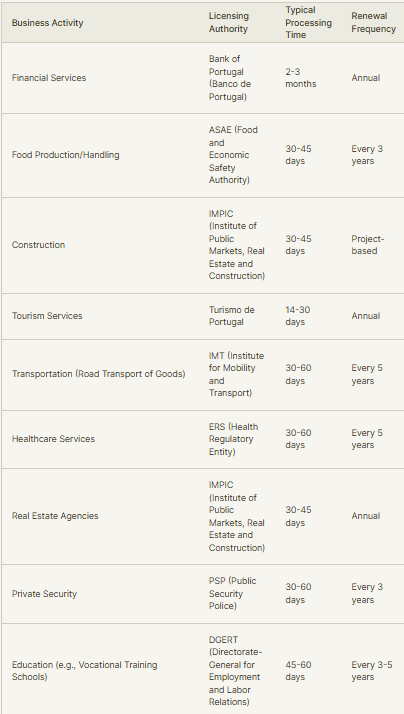

Please note that this table provides a general overview, and specific processing times and renewal frequencies may vary depending on the complexity of the business and local regulations. Always consult with the relevant Portuguese authorities or a legal professional for the most up-to-date and accurate information regarding licensing requirements for your specific business activity.

With over twelve years of experience, the House of Companies team has been empowering entrepreneurs around the world to launch their businesses.

Did you know that you can register a branch in Portugal in as little as one day?

Are you wondering if a notary is required to register a branch in Portugal? The good news is that it is not necessary.

By using our Entity Portal, entrepreneurs starting their business in Portugal can rest assured they’ll be able to open an IBAN payment account with ease.

While forming a local company, such as an Lda (limitada), remains popular, more and more entrepreneurs are opting to register a branch in Portugal. House of Companies has been a pioneer in helping entrepreneurs globally achieve this with less reliance on costly advisors and notaries, making the process smoother and more cost-effective.

How about we discuss your choices?

Absolutely! One of the great advantages of Portugal is that you don’t need to be a resident to launch a business there. You can establish your company as long as you have a registered address in Portugal and meet the necessary legal requirements. To get started, you'll need a local agent to represent your interests and officially register your business with the Portuguese Commercial Registry.

While the process might initially seem daunting, with expert guidance, you can swiftly navigate through the steps and have your business up and running in no time. Entrepreneurs from all around the world are drawn to Portugal for its robust economy, strategic location, and business-friendly environment.

So, don’t let being a non-resident hold you back—take full advantage of the opportunities available and turn your business vision into reality in Portugal!

How about we discuss your choices?

An efficient way to establish a presence in Portugal without setting up a full-fledged corporation is by opening a representative office. This type of office serves as a valuable intermediary, bridging your company with potential partners and customers in Portugal.

A representative office offers numerous opportunities, such as networking, market research, and uncovering business prospects in the Portuguese market. While it cannot generate direct income, it provides a strategic and low-risk approach to entering the market.

When you're ready to expand and start generating revenue, your representative office can be converted into a full-fledged branch. This transition allows your business to register for VAT, become an Employer of Record, and gain additional operational flexibility within Portugal.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!