Unlock Global Growth with Expert VAT Compliance in Portugal! Whether you're a startup taking your first steps internationally or a multinational exploring new markets, mastering VAT registration is essential. Let Portugal guide you through the complexities of VAT compliance, simplifying the process and ensuring smooth expansion into emerging economies. Don't let VAT hold you back—take control with expert knowledge and tools for seamless international success.

VAT can be tricky, especially when you're trading internationally. Whether you're looking to apply the One Stop Shop in Europe, use the Reverse Charge Method, or secure the Art.23 Exemption to skip VAT on imports, we’ve got the expertise to guide you every step of the way.

In Portugal, we make VAT registration and filing effortless for global entrepreneurs. Plus, we offer two additional services to simplify your process further, ensuring you can focus on growing your business without the VAT headaches. Let’s take the stress out of VAT—get in touch today!

Need help navigating your VAT obligations? Our team of specialists in Portugal can provide you with a personalized Advisory Report, packed with insights and recommendations tailored to your business. Make informed decisions and optimize your VAT compliance strategy with expert guidance right where you need it!

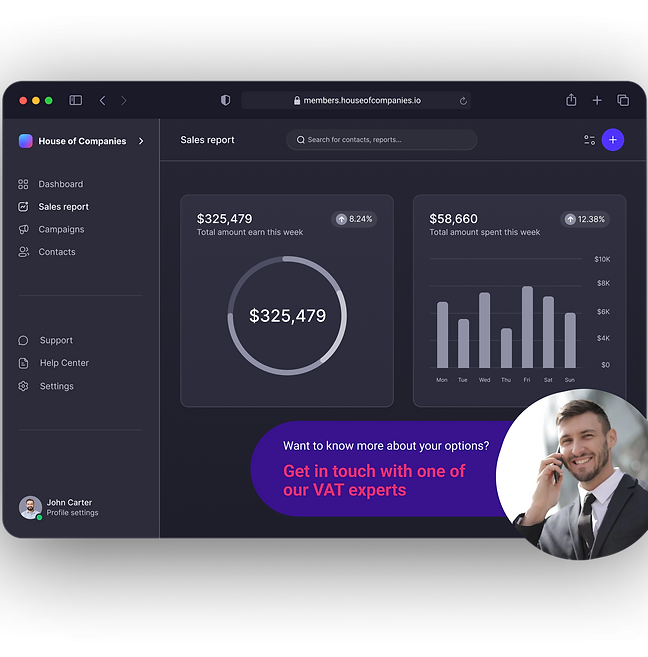

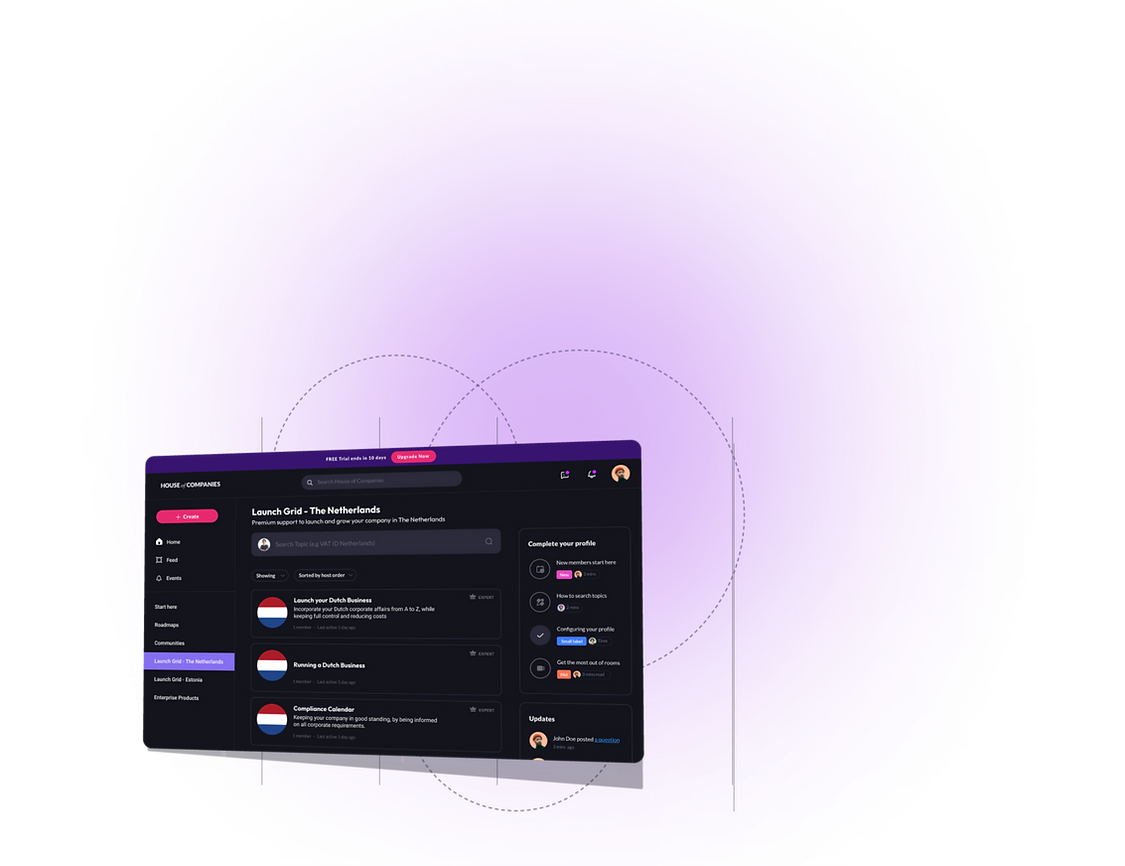

Our Business Portal provides an overview of all milestones towards activation of your VAT Number.

Enter our game-changing platform designed to streamline and simplify the VAT registration process. This innovative business portal provides a one-stop solution for companies looking to expand their operations globally. By leveraging technology and a team of VAT experts, our platform offers a seamless, user-friendly experience that breaks down the barriers of traditional VAT registration.

Our platform provides expert guidance throughout the VAT registration process in Portugal. Its team of VAT specialists is available to answer any questions and provide advice, ensuring that businesses are fully compliant with VAT laws in Portugal. This expert support helps to mitigate the risk of penalties and non-compliance, giving companies peace of mind as they expand their global operations.

"The automated VAT registration process saved us weeks of paperwork. Highly recommended for any tech startup in Portugal!"

Maria Silva

Maria Silva"The real-time VAT calculations have made pricing our products for the Portuguese market so much easier. Great service!"

Charles Richardson

Charles Richardson"The customer support is excellent. They're always available to answer our VAT-related questions, no matter how complex."

Tina Evans

Tina Evans

Learn More →

Learn More →

Learn More →

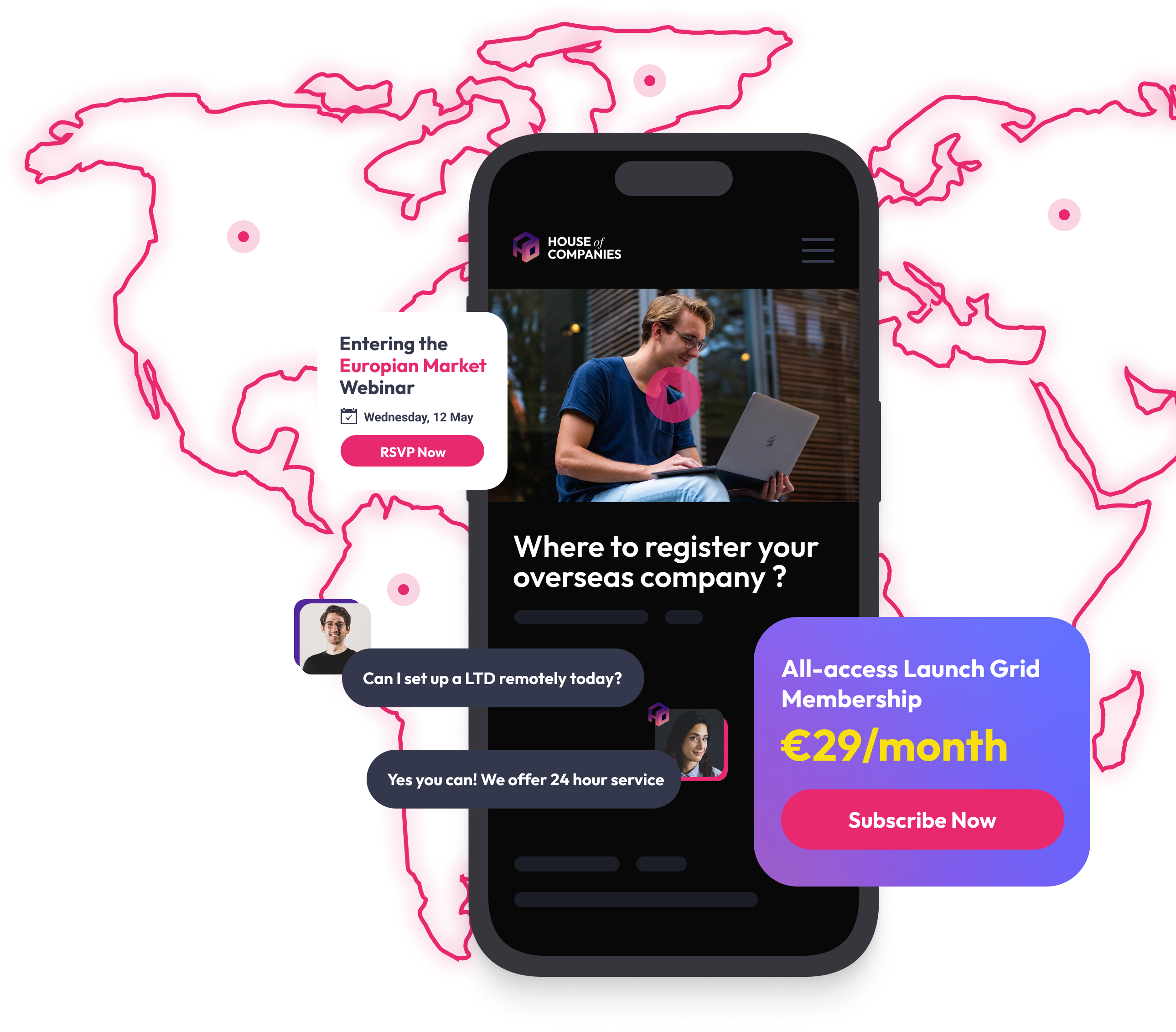

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!