Our Smart Company (SC) Registration service in Portugal provides a professional and efficient solution for businesses looking to establish a presence in this dynamic European market, including those involved in blockchain technology. Whether you are expanding from a non-EU country or diversifying your operations within the EU, we offer comprehensive support to help you navigate the legal and regulatory requirements for SC registration.

As part of our entity management services, we ensure that your blockchain business complies with Portuguese corporate laws while taking advantage of the country’s business-friendly environment. Our service includes everything from document preparation to liaising with local authorities, ensuring a smooth and hassle-free registration process. We understand the unique needs of blockchain ventures and tailor our approach to meet the specific regulatory and operational demands of this innovative sector.

Our experienced team is committed to providing tailored customer services for business entities, guiding you through the entire registration process. We help strategically position your blockchain company for growth in Portugal and beyond, from initial setup to ongoing compliance and expansion.

From start to finish, we minimize administrative burdens, allowing you to focus on leveraging blockchain technology and growing your business in European and international markets. With our support, you can navigate the complexities of blockchain regulations and position your company for success in Portugal’s progressive and growing business landscape.

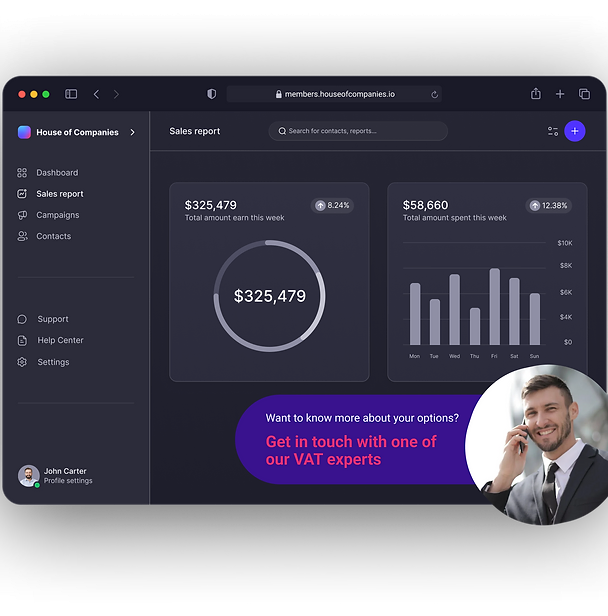

Registering a Smart Company (SC) in Portugal is now more efficient and flexible than ever with our cutting-edge Self-Governance Portal. This innovative platform is designed to streamline your business setup process, integrating advanced blockchain technology to enhance transparency, security, and efficiency. Whether you're expanding into the EU or establishing a base in Portugal for global operations, our service offers a comprehensive solution for all your corporate registration needs.

Blockchain Technology Integration: Our Self-Governance Portal utilizes blockchain technology to ensure the integrity and immutability of your registration data. This advanced approach not only enhances security but also guarantees that all transactions and document submissions are recorded transparently and are tamper-proof.

Key Benefits of Using Our Self-Governance Portal:

Quick, Streamlined Registration: The integration of blockchain technology accelerates the registration process by reducing delays and automating key steps. This means your Smart Company can be operational quickly and efficiently.

Full Compliance Support: We manage all aspects of compliance with Portuguese corporate laws, utilizing blockchain to ensure reliable and accurate documentation management. This way, your company meets all legal requirements with minimal administrative burden.

Tailored Customer Service: Our team of entity management experts offers personalized support, addressing the specific needs of your business and leveraging blockchain tools to optimize communication and documentation.

Our Smart Company Registration service is a crucial part of our broader entity management offerings, perfect for businesses looking to establish a strong presence in Portugal and expand globally. Start your registration with confidence using our advanced Self-Governance Portal, and take advantage of the security and efficiency that blockchain technology provides. Expand your global footprint and achieve lasting success with our expert support.

Access Our Self-Governance Portal

To begin your Smart Company registration, log into our Self-Governance Portal, where you will have full control over the registration process. The portal is designed to simplify your interaction with Portuguese authorities, allowing you to manage necessary documentation and legal requirements in a streamlined and user-friendly interface.

Choose the SC Structure

Determine the type of Smart Company that best suits your business needs. You can choose from various structures depending on your industry, size, and business model. Our team of experts is available to guide you on which structure will provide the most benefit, both operationally and tax-wise.

Submit Required Documents

The following documents are typically required to register a Smart Company in Portugal:

Company Name Reservation

Through the portal, you can verify and reserve your company name to ensure it is unique and meets Portuguese legal requirements. This step is crucial to avoid any conflicts or delays during the registration process.

Sign the Notarial Deed of Incorporation

Once your documents are in order, a notary will prepare and sign the Deed of Incorporation. This legal document formalizes the creation of your Smart Company, and we facilitate this step by coordinating with registered notaries to ensure everything is handled efficiently.

Register with the Portuguese Commercial Registry (Conservatória do Registo Comercial)

Your Smart Company must be officially registered with the Portuguese Commercial Registry (Conservatória do Registo Comercial). Our portal connects you directly with the Registry, ensuring seamless submission of all required documentation. Upon registration, your company will receive a unique registration number, confirming its legal status in Portugal.

Register for Portuguese Tax Numbers

To operate legally, your Smart Company must obtain a Portuguese tax identification number (NIF) and a Value-Added Tax (VAT) number if applicable. Our team facilitates this process through our portal, making sure your company is registered with the Portuguese tax authorities without any hassle.

Open a Corporate Bank Account

A corporate bank account is essential for financial operations. We can assist you in opening an account with a reputable Portuguese bank, ensuring your business can transact smoothly both locally and internationally.

Finalize Registration and Begin Operations

Once all steps are completed, you will receive final confirmation of your Smart Company’s registration, allowing you to officially start operations in Portugal. Our team remains on hand for any post-registration support, ensuring your company runs efficiently and complies with all legal requirements.

Registering a Smart Company (SC) in strategic jurisdictions can offer significant advantages, depending on your business goals and operational needs. Each jurisdiction presents unique benefits, making it essential to choose the right one for your expansion plans.

Portugal

Portugal offers a highly attractive environment for Smart Company registration, with a combination of competitive tax rates, a skilled labor force, and an open economy. With access to the EU market, Portugal provides businesses with opportunities to expand within Europe and benefit from favorable tax treaties. The country’s growing tech ecosystem, advanced infrastructure, and strategic location on the Iberian Peninsula make it an ideal choice for businesses looking to operate in Europe and internationally. Additionally, Portugal’s commitment to digital transformation and innovation makes it a great base for technology-driven businesses.

The Netherlands

The Netherlands is a prime choice for Smart Company registration, thanks to its favorable business environment, strategic position within the EU, and robust legal framework. Businesses registered in the Netherlands benefit from access to the EU market, favorable tax treaties, and a highly skilled workforce. The country also boasts advanced infrastructure, making it ideal for companies looking to expand within Europe.

The United Kingdom

The UK remains a strong contender for SC registration despite Brexit. It offers a simple and fast registration process, favorable corporate tax rates, and a well-established legal system. The UK’s global trade connections and strong economic standing continue to make it an attractive option for businesses aiming to expand into international markets.

Singapore

Singapore stands out as a global financial hub and is a top jurisdiction for Smart Company registration, particularly for businesses targeting Asia. With its low corporate tax rates, tax exemptions for new companies, and strong intellectual property protections, Singapore provides a highly favorable environment for businesses. Its strategic location also offers easy access to Asian markets.

The United Arab Emirates (UAE)

The UAE is renowned for its free zones, which offer unique benefits such as 100% foreign ownership, no corporate or income tax, and a world-class business infrastructure. The UAE’s free zones are particularly advantageous for businesses seeking tax-free operations in a strategic location with global connectivity.

Hong Kong

Hong Kong is another key jurisdiction, known for its low taxes, free trade policies, and minimal restrictions on foreign investments. It is an ideal location for businesses targeting the Asia-Pacific region, offering access to major markets like China. With its status as a global financial center, Hong Kong remains a top destination for SC registration.

United States

States like Delaware provide a favorable environment for Smart Company registration, particularly due to their strong legal systems, investor protections, and favorable corporate tax structures. The U.S. offers access to the world’s largest economy and a vast domestic market, making it a key jurisdiction for companies looking to grow internationally.

Luxembourg

Luxembourg offers excellent opportunities for Smart Company registration within the EU. It provides flexible corporate structures, a favorable tax regime, and strong banking and financial services. Luxembourg’s extensive network of double taxation treaties makes it an attractive choice for businesses operating across borders.

Setting up a Smart Blockchain business in Portugal can offer a unique opportunity to tap into the growing blockchain ecosystem, benefit from a robust legal and regulatory environment, and access the European Union market. Portugal is increasingly becoming a popular destination for technology startups, particularly in sectors such as blockchain and cryptocurrency, due to its innovation-friendly policies, skilled workforce, and favorable tax regimes.

Here’s a step-by-step guide to help you establish your Smart Blockchain business in Portugal:

1. Understand Portugal’s Blockchain Landscape

Before setting up your business, it’s crucial to understand the regulatory and operational environment for blockchain in Portugal. While Portugal has no specific legislation exclusively for blockchain, its legal framework is becoming more accommodating toward digital innovation and fintech startups. The Portuguese government has been progressively embracing blockchain technology for applications like digital identity, e-government services, and fintech.

Portugal has also established a reputation as a cryptocurrency-friendly country with no VAT on cryptocurrency transactions, which makes it an attractive destination for blockchain-related businesses.

2. Choose the Right Business Structure

The first step in setting up a blockchain business is to determine the appropriate legal structure for your company. Portugal offers various business structures that are suitable for blockchain startups, including:

Sole Proprietorship (Empresário em Nome Individual): Best for small businesses or individual entrepreneurs.

Limited Liability Company (Sociedade por Quotas, Lda.): Ideal for small to medium-sized businesses. This structure limits the liability of shareholders.

Public Limited Company (Sociedade Anónima, S.A.): Suitable for larger businesses with higher capital requirements.

Branch of a Foreign Company: If you already have a company established elsewhere, you can set up a branch in Portugal.

Blockchain businesses generally opt for a Sociedade por Quotas (Lda.) due to its flexible structure, limited liability, and relatively straightforward compliance requirements.

3. Register Your Blockchain Company

Once you’ve selected your business structure, the next step is to register your blockchain company with the Portuguese Commercial Registry (Conservatória do Registo Comercial). This process involves:

Choosing a company name and verifying its availability with the registry.

Drafting the Articles of Association: This document outlines your company’s operations and governance.

Providing identification for the company’s shareholders and directors (e.g., passports or national IDs). Registered office address in Portugal. The registration process in Portugal is fast, and it can typically be completed online, especially through the Company in a Day service, which allows for the swift creation of companies.

4. Obtain Necessary Licenses and Permits

While there are no specific licenses required to operate a blockchain business in Portugal, depending on your business’s nature (e.g., if you deal with cryptocurrency exchanges or financial services), you may need to comply with additional regulations or obtain permits.

For example:

Crypto-related activities: If your business involves cryptocurrency exchanges, wallet services, or any activities classified under the Portuguese Securities Market Commission (CMVM) or Banco de Portugal supervision, you may need to apply for specific licenses.

Data protection: Compliance with the General Data Protection Regulation (GDPR) is essential if your blockchain solution deals with personal data.

Consulting with a legal expert specializing in blockchain and cryptocurrency law in Portugal can help ensure you meet all regulatory requirements.

5. Register for Taxes

To operate legally in Portugal, your blockchain business must be registered with the Portuguese Tax Authority (Autoridade Tributária e Aduaneira). This includes obtaining a Tax Identification Number (NIF) for your company.

If your blockchain business involves providing goods or services subject to VAT, you must also register for VAT. Portugal offers a low corporate tax rate (21%) with potential reductions depending on the size of your business, making it an attractive destination for tech companies.

You may also want to explore Portugal's StartUp Visa program, which allows for tax benefits for startups, especially those in high-tech sectors such as blockchain.

6. Set Up a Corporate Bank Account

To operate in Portugal, your blockchain business will need a corporate bank account for day-to-day operations, including managing finances, paying taxes, and handling employee salaries. There are various reputable banks in Portugal that offer business accounts, and many banks now cater to fintech and blockchain companies, understanding the unique needs of these sectors.

Some banks may have specific requirements related to blockchain or cryptocurrency businesses, so it's advisable to consult with your chosen bank beforehand to understand their policies.

7. Implement Blockchain Technology and Infrastructure

After establishing your business, the next step is to focus on the technical setup. If your blockchain business involves developing blockchain solutions, you’ll need to:

Choose a blockchain platform: Select the appropriate blockchain technology (e.g., Ethereum, Hyperledger, Polkadot) based on your business model and use case.

Hire skilled talent: Portugal has a growing tech ecosystem with a good supply of blockchain developers and IT professionals. Cities like Lisbon, Porto, and Braga are known for their tech talent and digital innovation hubs.

Set up blockchain infrastructure: Depending on your needs, you may require dedicated servers or cloud services to host your blockchain nodes, smart contracts, or decentralized applications (dApps).

8. Market Your Blockchain Business

Portugal’s tech community and startup ecosystem are vibrant and growing, making it a great place to network, attract investors, and expand your business.

To promote your blockchain business, consider:

9. Explore Funding and Investment Opportunities

Portugal offers several funding opportunities for tech startups, particularly in blockchain and fintech sectors. Explore programs such as Portugal 2020, a government initiative offering financial support to businesses that drive innovation, and other EU programs designed to encourage technology-driven entrepreneurship.

Consider seeking investment from local venture capitalists, angel investors, or blockchain-specific funding initiatives. Portugal’s growing tech scene is supported by investors looking to support blockchain and fintech innovations.

10. Stay Compliant with Ongoing Regulations

Finally, staying compliant with evolving blockchain regulations is crucial. Keep up with regulatory changes from Portuguese authorities and the EU that may impact the blockchain industry. Regularly consult with legal advisors to ensure that your business complies with the latest regulations concerning financial services, data protection, and blockchain technology.

What are the initial steps to set up a blockchain business in Portugal?

Start by conducting market research, choosing a suitable business structure (e.g., Sociedade por Quotas - Lda), and registering your company with the Portuguese Commercial Registry.

Do I need a specific license to operate a blockchain business in Portugal?

It depends on your business activities. For example, cryptocurrency exchanges and wallet services must comply with AML and CTF regulations and register with Banco de Portugal.

What is the corporate tax rate for blockchain businesses in Portugal?

The standard corporate tax rate is 21%, but SMEs benefit from a reduced rate of 17% on the first €25,000 of taxable income.

Are there any tax incentives for blockchain businesses in Portugal?

Yes, Portugal offers various tax incentives, including R&D tax credits, the Patent Box regime, and benefits for businesses in the Madeira Free Trade Zone.

What are the key regulatory bodies for blockchain businesses in Portugal?

The main regulatory bodies are the Comissão do Mercado de Valores Mobiliários (CMVM) and Banco de Portugal.

How can I protect my intellectual property in Portugal?

Register your patents, trademarks, and copyrights with the Portuguese Institute of Industrial Property (INPI). Portugal's IP laws are aligned with EU standards.

What funding options are available for blockchain startups in Portugal?

Explore venture capital, angel investors, government grants, and programs like Startup Portugal, which supports innovation and internationalization.

Is it necessary to have a physical office in Portugal?

While a physical office is not mandatory, having a registered business address is required. Many startups opt for virtual office services.

How can I ensure compliance with data protection regulations?

Ensure compliance with the General Data Protection Regulation (GDPR) and implement robust cybersecurity measures to protect personal data and blockchain infrastructure.

What are the best strategies for marketing a blockchain business in Portugal?

Develop a strong online presence, utilize digital marketing strategies, participate in blockchain conferences, and build partnerships within the industry.

"The SMART Company registration process in Portugal was seamless, and the guidance we received made it easy to decentralize our operations globally. We’ve been able to grow our business and streamline our operations within the EU."

Alex J

Alex J"Portugal’s strategic location within the EU and its supportive regulatory environment made registering a SMART Company an easy decision. The House of Companies team provided expert advice every step of the way."

Maria L

Maria L"Choosing Portugal for our SMART Company registration was a strategic decision. The country’s tax advantages and business-friendly environment have already contributed to our success."

David R

David RThe registration of a Smart Company in Portugal might not be the ideal choice for everyone. In our blogs and roadmaps, we provide a detailed analysis of the pros and cons for each country, including Portugal, to help you make an informed decision.

If you determine that incorporating a local company is the best route for your business, House of Companies is here to assist you with the entire incorporation process. We guide you through the registration of a Portuguese company, ensuring compliance with local regulations and providing expert advice on the most suitable business structure for your goals. Whether you choose a Limited Liability Company (Lda.), a Public Limited Company (S.A.), or any other structure, our team is dedicated to making the process smooth and efficient.

Feel welcome, and try out our solutions and community, to bring your business a step closer to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!