One Control Panel to handle your company's incorporation and understand corporate hurdles during your expansion into Portugal. The most cost-effective way to establish your company, with tools and community support for successful market entry.

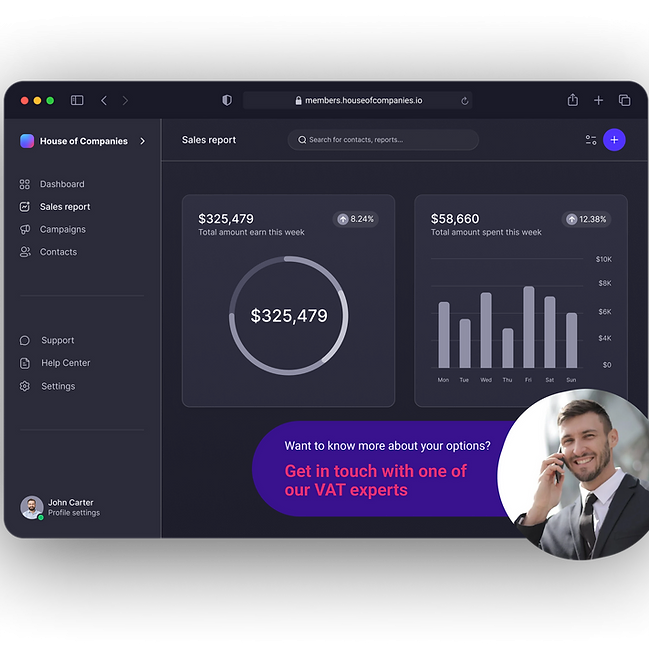

Filing VAT returns in Portugal is becoming increasingly straightforward with the Autoridade Tributária e Aduaneira's online portal. Our Entity Management system simplifies this process further, allowing you to submit your VAT refund efficiently when you sign up for a Free Trial.

After submitting your first VAT return, continue using our Entity Management to grow and manage your company in Portugal!

"Their Entity Management system is a game-changer. We managed to file our VAT returns without any hassle."

João R

João RThe streamlined VAT filing process made everything so much easier. Their support is top-notch, and I can’t recommend them enough for anyone looking to enter the Spanish market.

Carlos RiveraOperations Manager

Carlos RiveraOperations ManagerTestimonial 3

John SmithCEO

John SmithCEO"Their platform is user-friendly and efficient. We were able to file our VAT returns quickly and without any issues."

Carlos Rivera

Carlos Rivera"We saved a lot of time and effort by using their Entity Management system for our VAT filings in Portugal."

Catarina D

Catarina DWhile our Entity Management is comprehensive, some situations may require a local Portuguese tax expert. In certain cases, Portuguese law may require a local accountant.

House of Companies is ready to assist with your Portuguese tax return. We can work with your existing ledgers and VAT analysis or create new ones from scratch, ensuring compliance with Portuguese regulations.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!